Turning the Dial: Tech Mahindra's Q1FY26 Signals Progress, but Hurdles Remain

Steady Hands Amid Shifting Sands

Tech Mahindra’s Q1FY26 results serve up a mix of cautious optimism and lingering headwinds: a quarter marked by margin improvement and strong order wins, even as topline growth remains subdued.

For both long-term believers and battle-hardened skeptics, the latest numbers offer evidence that the turnaround story is gathering steam, but it isn’t time to toss aside risk caution just yet, especially when the valuation is similar to the other large-cap peers!

Key Financials: Margins Shine, Growth Muted

Revenue: $1,564 million (up 1% QoQ, up 0.5% YoY in reported terms; down 1.4% QoQ, down 1% YoY in constant currency)

EBIT: $172 million; EBIT margin at 11.1% (up 50bps QoQ, up 60bps YoY)

Net Profit (PAT): $133 million, up a robust 30% YoY

Free Cash Flow: $86 million, a seasonal dip

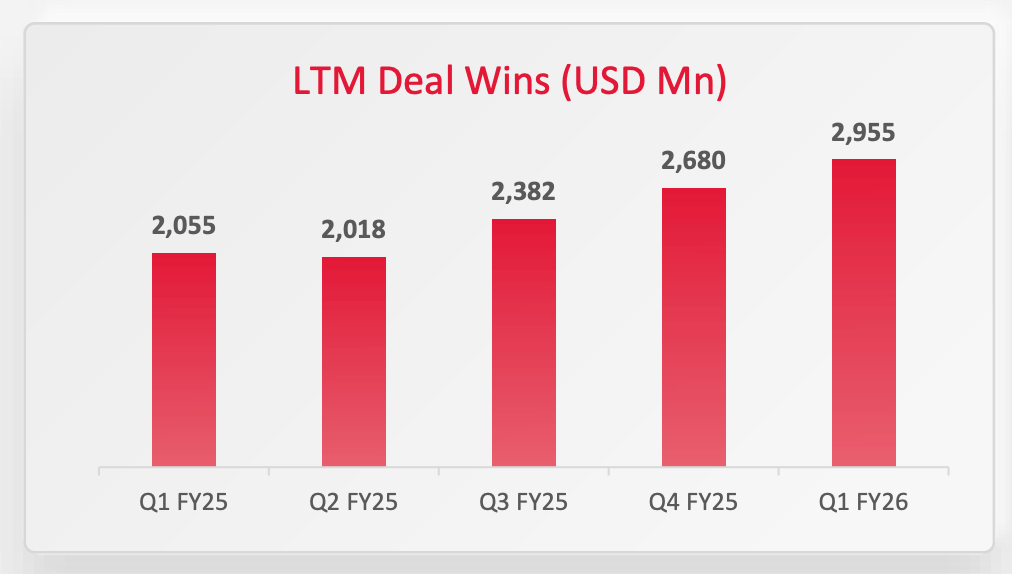

Order Book: Strong TCV of $809 million, up 44% YoY LTM

The margin trajectory is the clear bright spot; TechM notched its seventh consecutive quarter of expansion. However, revenue growth still lags the peer set and the sector’s historic averages. Management’s disciplined approach to deal-making, operational rigor, and ongoing cost optimization stand out as deliberate positives. CFO Rohit Anand flagged that several tailwinds: offshoring, operational levers, and savings from Project Fortius which offset some continued cost pressures from seasonality, visas, and lower utilization.

Segment & Geography Insights: Diverging Paths

Verticals:

Communications (33.8% of revenue): Grew 2.5% YoY as stabilization set in, especially among top clients. Management highlights new deal momentum in telco and digital platforms.

Manufacturing (17.5%): Down 4% YoY, even as it was up 4% sequentially. Automotive exposure (primarily US) remains a drag; aerospace offered a silver lining.

BFSI (16.4%): Grew 4.7% YoY; continues to outpace the company average, backed by Fortune 500/Global 2000 client wins.

Hi-Tech (13.3%): Down 3.3% YoY due to semiconductor sector restructuring and budget cuts.

Retail, Healthcare, and Others: Retail posted steady 3.8% YoY growth, while Healthcare and "Others" were weak.

Geographies:

Americas: -5.9% YoY (but +2.6% QoQ); manufacturing slump weighs on overall numbers.

Europe: +11.7% YoY, reflecting both currency tailwinds and telco/manufacturing pipeline wins.

Rest of World: +2.9% YoY.

The Americas’ YoY weakness is a concern, even as sequential improvements in communications suggest a bottoming out. Europe is emerging as a relative bright spot, partly thanks to consolidated wins and favorable currency.

Margins & Efficiency: Operating Discipline Takes the Spotlight

EBIT margin: 11.1% (vs. 10.5% prior quarter)

Utilization: Dipped due to upfront talent investments for recently-won deals.

Attrition: IT LTM attrition rose to 12.6%, hinting at industry-wide workforce churn.

Subcontracting: Management reaffirmed a long-term band of 8–10% of revenue.

The core of the margin improvement comes from execution i.e. offshoring, tighter SG&A, and integration of past acquisitions. Yet, wage hikes scheduled for Q4FY26 are a potential headwind if not neutralized by productivity gains. Reduction in sales & support staff reflects cost-out initiatives, not a loss of front-line sales capacity.

Order Book / Deal Wins: Signs of Acceleration

Total contract value (TCV): $809 million (LTM up 44% YoY)

Large deal (> $25 million) momentum: Now a larger share of TCV, broad-based across verticals.

Notable wins: Partnerships with a leading US wireless operator (designated “growth partner”), a UK telco, a global hi-tech major (AI-driven platform deployment), and a major fashion retail brand (digital/data transformation).

Management points out that after several quarters of strong order signings, revenue conversion from these deals should start kicking in meaningfully from Q2 onwards, albeit assuming no further macro shocks.

Management Commentary: Steady, Resolute and Grounded

CEO Mohit Joshi was characteristically measured. He emphasized that “early results of structural changes and strategic choices are visible,” and that the priority for FY26 is bridging TechM’s historic growth gap with peers, not leapfrogging them. The transformation journey focuses on:

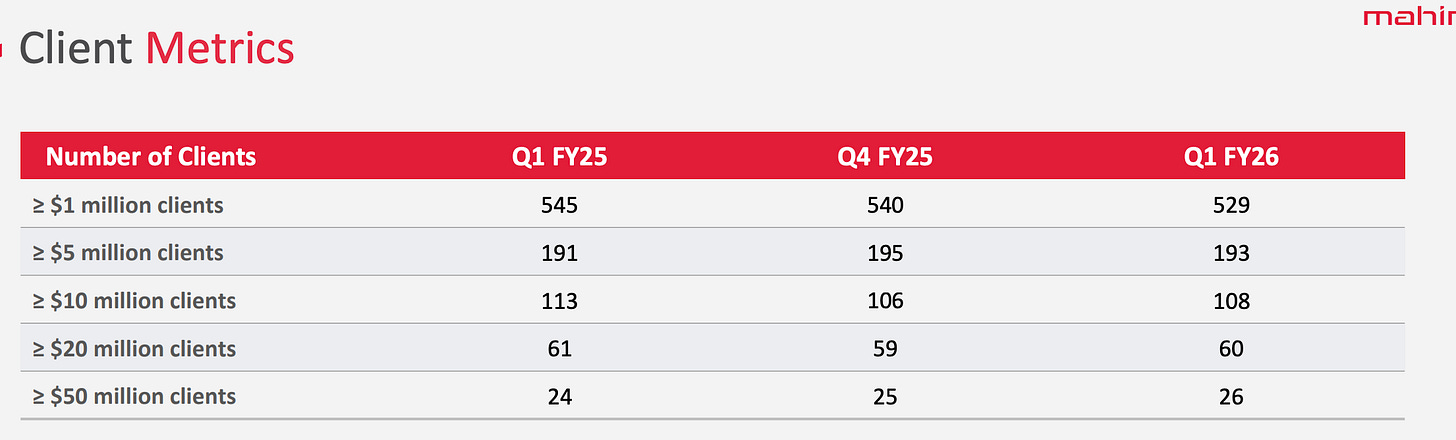

Deepening top-client engagement (Turbocharge program for “peak and prime” accounts)

Expanding new “must-have” Fortune 500/Global 2000 clients (15 added this quarter)

Pursuing only profitable, large multi-year deals, not “revenue at any price”

On AI, Joshi called out a portfolio of 200+ enterprise-grade AI agents, with 77,000+ employees now upskilled in GenAI which he believes is a differentiator and will matter more as client demand shifts from POCs to production deployments.

Peer Comparison: Still Catching Up

Growth: Tech Mahindra’s constant currency YoY revenue decline (-1%) trails its larger Indian IT peers:

TCS: Slight growth, but modest compared to historical levels.

HCL Tech: Slightly better traction, especially in services and ER&D.

Wipro: Also grappling with single-digit growth and margin recovery.

Margins: TechM’s margin recovery to 11.1% is a material improvement but still below TCS and Infosys (typically 20–22%), and a bit behind HCL Tech’s mid-teens margin. Still, the direction is unmistakably positive.

Order Wins: TechM’s $809M TCV this quarter is robust. Relative to its own history, this is a structural step up, although in absolute terms it remains behind TCS/Infosys.

Valuation & Market Reaction: Skepticism and Opportunity

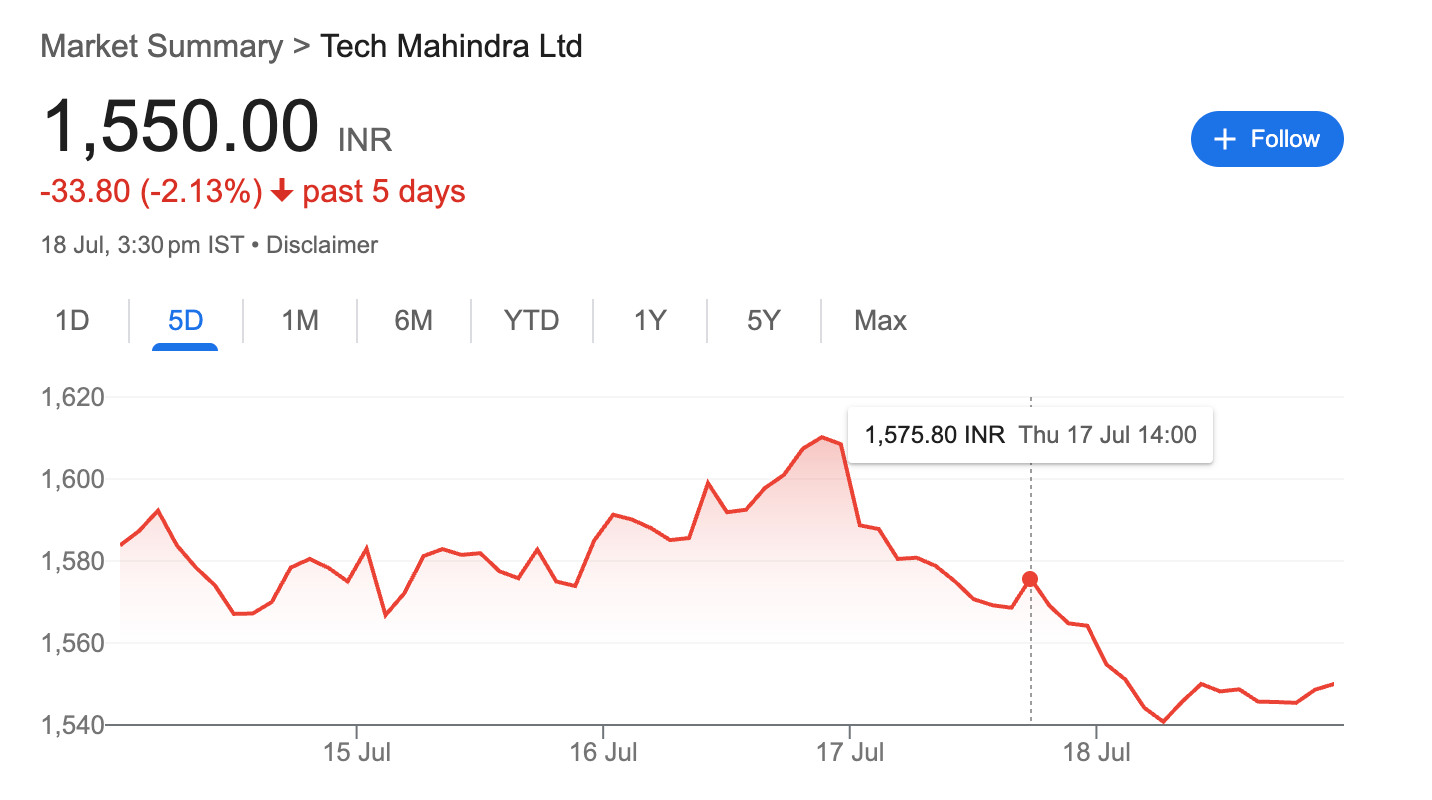

Post-results, Tech Mahindra stock’s declined a bit, reflecting a grudging acknowledgement of margin progress but caution due to the limp revenue growth and uncertain macros. The stock currently trades at a P/E of ~27x FY26E, comparable to larger peers despite a still-lower margin/return profile.

Investor sentiment appears split between value investors appreciating the turnaround in returns on capital/emerging cost discipline, and growth investors who want to see more proof of topline reacceleration.

Conclusion & Forward View: Promising, but The Jury's Out

Tech Mahindra’s Q1 numbers validate that the multi-year transformation playbook: anchored on margin expansion, client focus, and bold deal wins is showing tangible results. For now, the company is methodically closing its profitability gap and building the order book, with a management team that’s more candid than promotional.

But this journey remains in the balance. The challenges of manufacturing/auto weakness, high-tech sector wobble, and the sector-wide absence of strong demand momentum shouldn’t be underestimated. Investors should keep a close eye on:

Revenue conversion from the record deal pipeline beginning Q2

Margin resilience as wage pressures return

Progress on expanding large strategic accounts and further AI-driven differentiation

My one-liner: Tech Mahindra is no longer running just to stand still; the next two quarters will reveal whether it can truly pick up speed or settle for a longer jog in the middle of the pack.