Superb Accenture Q1FY25 Results. Why did Indian IT Stocks fall despite the good news?🔻📉

Scratching your head wondering why Indian IT stocks bled today while Accenture posted stellar results? Read below to find out👇

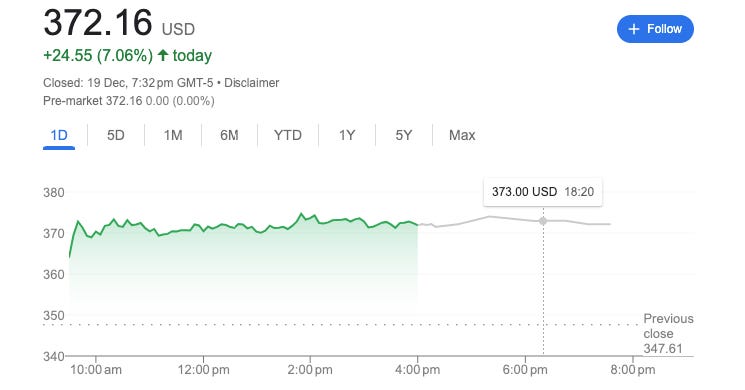

Accenture reported their Q1FY25 results on 19th December and left the Street positively surprised. The company posted quarterly revenue of $17.7 billion vs. the street estimates of $17.2 billion. The stock gained 7% in yesterday’s trading session.

Accenture has reported a strong start to fiscal year 2025, demonstrating broad-based revenue growth across all markets and industry groups. The company has raised its full-year revenue growth outlook, reflecting positive momentum.

Let’s analyze what worked for the company and what didn’t:

Key Financial Highlights:

Revenue: Accenture reported revenues of $17.7 billion in Q1 FY24, growing 9% in USD and 8% in local currency. This exceeded the company’s guidance range by $240 million.

Consulting revenue came in at $9.0 billion, up 7% in USD and 6% in local currency.

Managed services revenue was $8.6 billion, growing 11% in both USD and local currency.

New Bookings: Total new bookings reached $18.7 billion, marking a 1% growth in both USD and local currency.

Consulting accounted for $9.2 billion (49% of new bookings).

Managed services contributed $9.5 billion (51% of new bookings).

Generative AI-related bookings hit $1.2 billion.

Profitability:

Operating margin (GAAP) improved to 16.7%, up 90 basis points year-over-year and flat compared to adjusted margins.

GAAP EPS was $3.59, a 16% increase from $3.10 in the prior year and 10% higher than last year’s adjusted EPS of $3.27.

Cash Flow and Balance Sheet:

Free cash flow more than doubled to $870 million, up from $430 million in the same period last year.

The cash balance at quarter-end stood at $8.3 billion, significantly higher than $5.0 billion in the prior quarter.

Shareholder Returns:

A quarterly dividend of $1.48 per share was paid, reflecting a 15% increase over FY24 levels.

The company repurchased 2.5 million shares, amounting to $898 million.

How did various Geographies performed and what’s company saying about them?

Americas:

The Americas had a stellar quarter, with revenue growing 11% in local currency. The United States and Argentina were key drivers of this growth, highlighting strong demand across the region. Industrial, software and platforms, banking and capital markets, and consumer goods, retail, and travel services stood out as the top-performing sectors.

The robust performance across these verticals shows that clients in the Americas are prioritizing transformation and managed services. Unlike some other regions, the Americas showed no signs of a slowdown, indicating healthy and stable market conditions.

EMEA (Europe, Middle East, and Africa)

EMEA’s revenues grew 6% in local currency, but overall, it was a mixed bag. On the bright side, public service, life sciences, and health sectors drove growth, with strong contributions from the United Kingdom and Italy.

However, France saw a decline, and banking and capital markets faced headwinds across the region. Accenture noted that Europe is navigating a challenging economic environment, with some softness in demand over the last few months. Despite these hurdles, the company is confident in its ability to support clients here, leveraging its deep expertise and strong client relationships.

Asia Pacific

Asia Pacific posted a modest 4% revenue growth in local currency, led by Japan, which accounts for roughly half of the region’s revenue. The utilities, industrial, and health sectors were standout performers, showing that clients in these industries are focusing on innovation and transformation.

However, the region wasn’t without challenges—chemicals and natural resources saw declines, and markets like Singapore and Australia underperformed. While the growth was slower than in other regions, Accenture’s ability to tap into high-growth sectors like utilities shows its resilience in a diverse market.

What is the Company saying about the overall macro environment for Discretionary IT Spends?

Accenture has observed that smaller discretionary IT spends remain constrained in the current macro environment. Clients are cautious with their budgets, focusing less on smaller, less critical projects and instead channeling resources toward transformative initiatives. Julie Sweet, the CEO, highlighted that while overall IT spending hasn’t increased, companies are prioritizing investments in large-scale reinvention projects that align with their strategic goals, such as cost optimization, digital transformation, and building foundational capabilities for technologies like cloud and GenAI.

Accenture has adapted well to the current market environment by focusing on large-scale deals, many of which exceed $100 million. These projects typically involve complex, organization-wide transformations that draw on the company’s expertise in both consulting and managed services. This strategic pivot has allowed Accenture to thrive, even as smaller discretionary IT spending remains limited.

By positioning itself as the “reinvention partner of choice” Accenture has tapped into its clients’ need for mission-critical initiatives. This approach has not only helped the company maintain steady growth despite economic challenges but also solidified its reputation as a leader in helping businesses navigate uncertainty and prepare for the future.

Looking ahead, Accenture is optimistic about its ability to capture even more market share when discretionary spending begins to recover. With its strong focus on strategic, high-value programs, the company expects to be well-positioned to benefit from any shifts in client priorities. More clarity on these trends is anticipated early next year as client budgets for 2025 are finalized, typically around January and February.

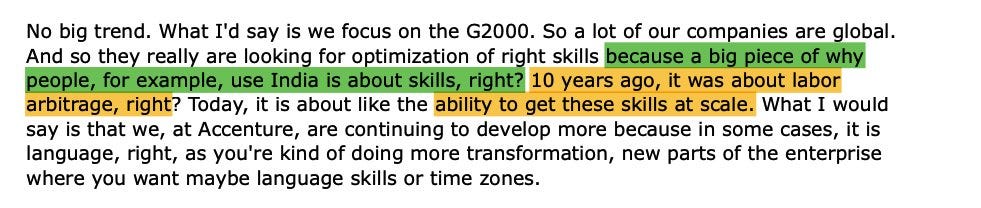

What did the company say about hiring from India?

Accenture shared that a significant portion of its recent hiring has been focused in India, underscoring the country’s importance as a key talent hub. India offers a deep pool of highly skilled professionals, making it a natural choice for building capacity in critical areas like technology, digital services, and advanced engineering.

The management pointed out that the company’s approach to hiring in India has evolved. It’s no longer just about cost savings or labor arbitrage, which were primary drivers in the past. Now, it’s about tapping into specialized skills and scaling quickly to meet client needs in cutting-edge areas like GenAI, cloud, and full-stack engineering.

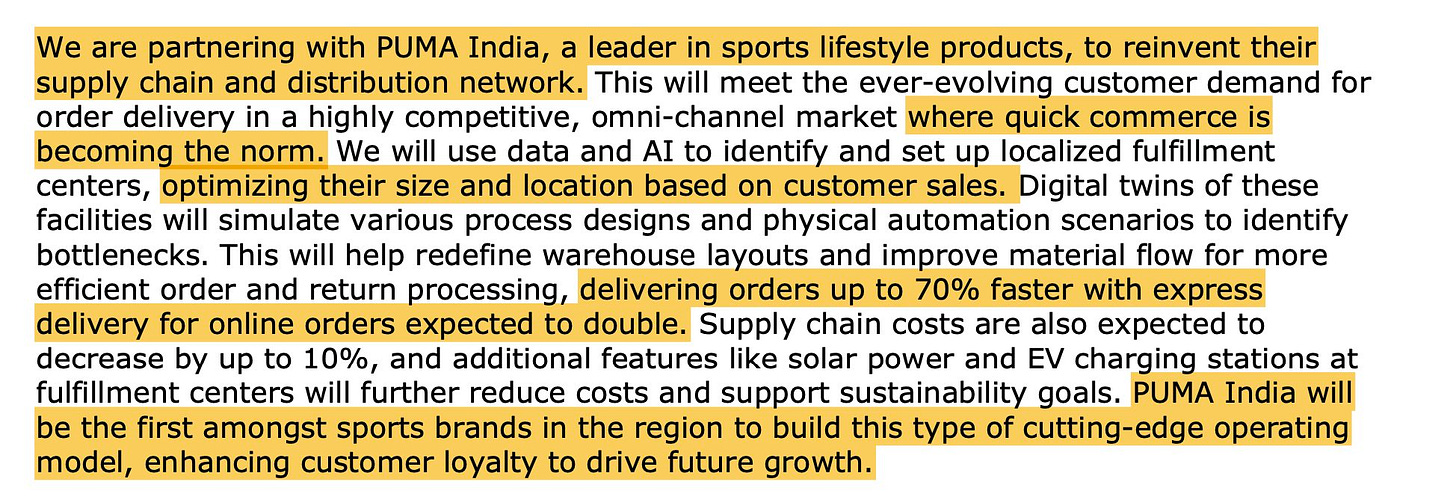

Client in Focus: PUMA India

Accenture is partnering with PUMA India to overhaul their supply chain and distribution network. The company is aiming to meet the growing demand for quick-commerce in a competitive, multi-channel market. The primary goal of this project is to transform PUMA India’s operations to improve delivery speed and efficiency. The collaboration will leverage data and AI to identify optimal locations for localized fulfilment centres, based on customer sales data. Digital twins of these centres will be created to simulate various process designs and automation scenarios, helping to identify bottlenecks and enhance operational flow.

One of the main targets is to increase order delivery speed by up to 70%, with express delivery for online orders expected to double. The project also anticipates a reduction in supply chain costs by up to 10%. To support sustainability goals, the new fulfilment centres will incorporate eco-friendly infrastructure, such as solar power and electric vehicle (EV) charging stations.

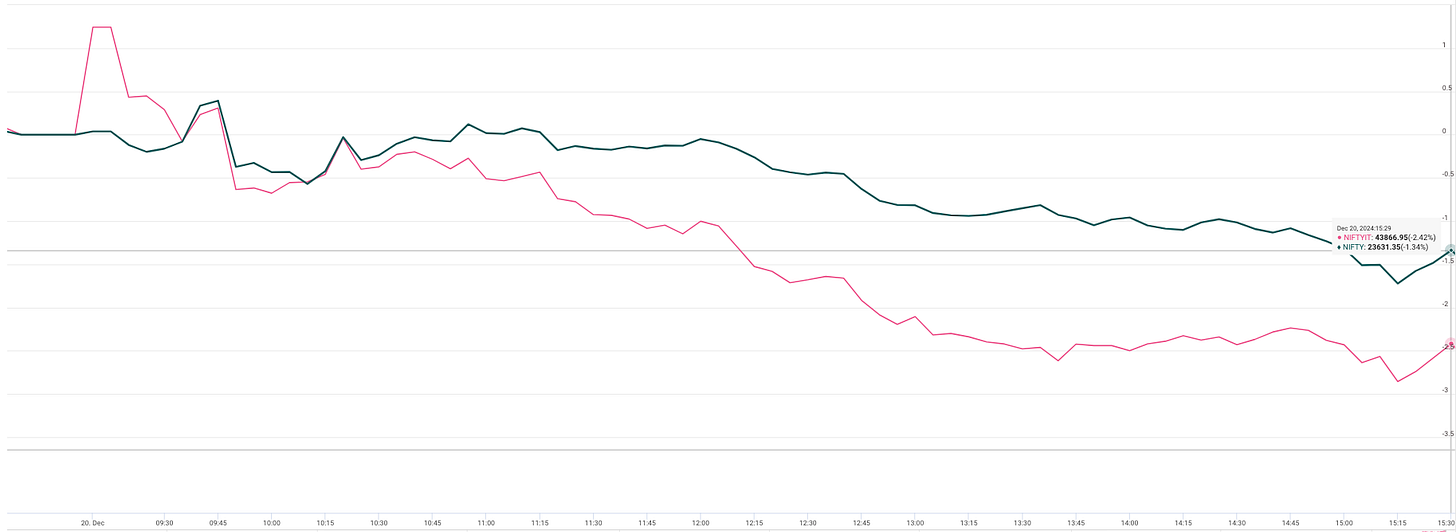

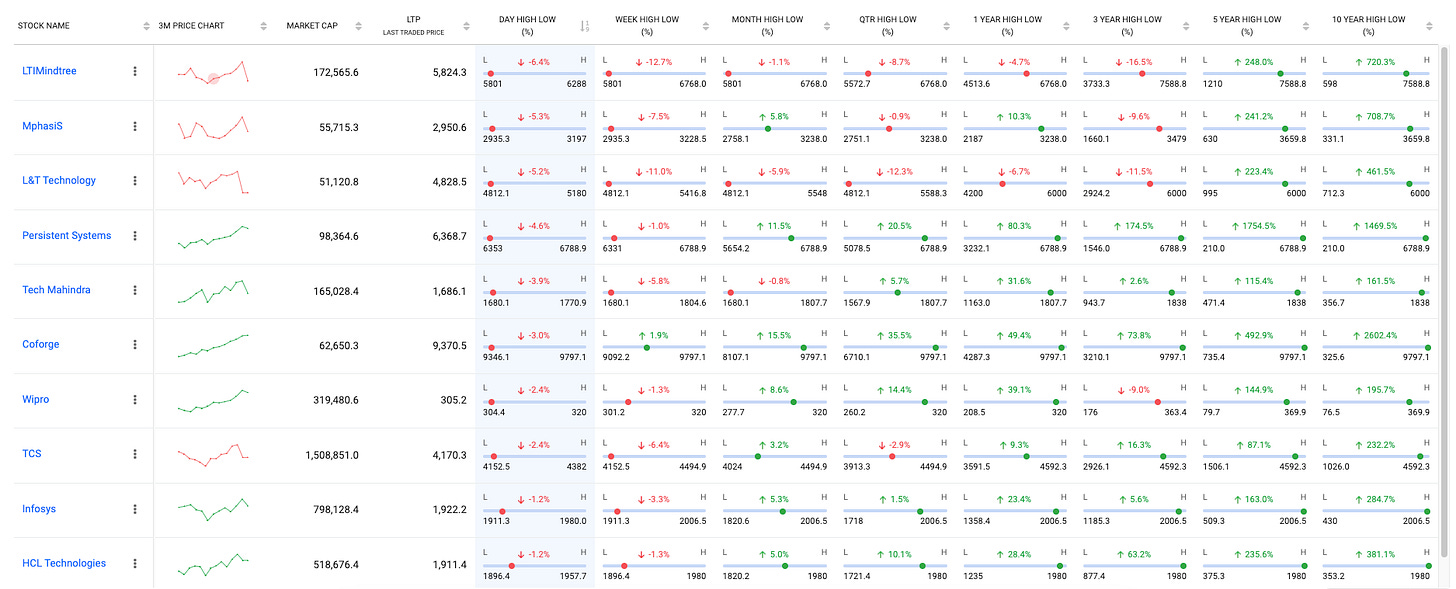

Despite Accenture's strong Q1 performance, Indian IT stocks experienced a steep decline. The Nifty IT index declined 2.42% whereas the broader NIFTY 50 index declined only 1.34%.

LTIMindtree, Mphasis, LTTS, and Persistent turned to be biggest losers amongst the pack. These companies were touted as the fast growing IT companies and were the leaders in the IT rally of past couple of months. However, with the recent market selloffs and the hawkish stance of Federal Reserve, there has been a reset in market expectations and hence the reason for the bloodbath!

Federal Reserve’s Hawkish Stance playing the Spoilsport:

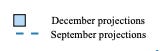

The Federal Reserve’s recent hawkish stance has significantly impacted the Indian IT sector, leading to a sharp drop in stock prices and raising concerns about future demand. Despite cutting interest rates by 25 basis points to a range of 4.25% to 4.5%, the Fed’s forward guidance has become more cautious, with fewer rate cuts expected in 2025 and continued efforts to control inflation. The Fed’s recent actions, including a closely contested decision to reduce rates in December, suggest that monetary policy is approaching a neutral stance, which has created an uncertain environment for global markets.

In the summary of Economic projections released by the Federal Reserve, we can clearly see that more participants in the FOMC committee looks at the rate to remain ‘higher for longer’ and hence the primary reason for the hawkish stance.

The primary concern for Indian IT companies is the potential slowdown in demand from US clients due to higher interest rates, which could reduce discretionary IT spending. Economic uncertainty, both in the US and globally, adds to the challenges. Tighter monetary policies could slow economic growth, which would indirectly affect the Indian IT sector. Political factors, such as potential tariffs under the incoming US administration, further complicate the situation.

The broader market has also been affected, with the Sensex and Nifty indices experiencing significant declines. The future performance of the IT sector will depend on several factors, including the Fed’s future decisions, global economic conditions, and currency fluctuations. Despite a strong rally in the IT sector over the past three months, the recent developments have led to caution among investors and analysts regarding the sector’s near-term prospects.