LTIMindtree Q1FY26: Margin Gains and Robust Deal Wins Signal Path to Recovery

Margin Expansion, Strong Pipeline, and Signs of Post-Merger Stability at India’s Digital Challenger

LTIMindtree’s first quarter of FY26 brought a whiff of optimism to a sector still searching for stronger growth. Margin improvements, a clutch of large deal wins, and steady execution marked a quarter where the company showed clear intent to recalibrate after a string of macro and merger-related headwinds.

This feels less like a dramatic turnaround and more like a well-laid foundation for better days.

Financial Snapshot: Margins Up, Growth Muted, Order Book Grows

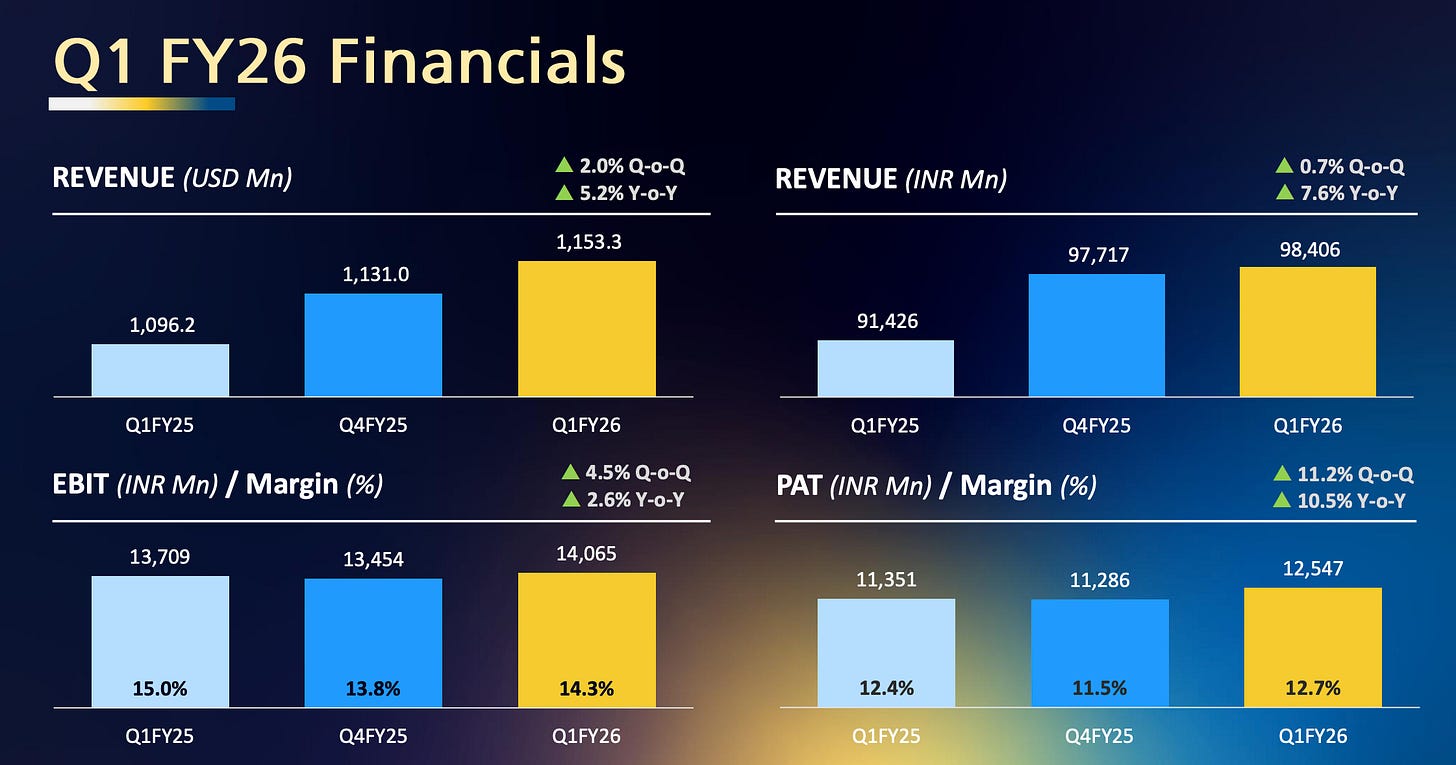

Revenue: $1,153 million, up 2.0% sequentially, up 5.2% YoY (in reported USD). Constant currency growth was 0.8% QoQ and 4.4% YoY.

EBIT Margin: 14.3%, up 50 basis points QoQ, with improvement attributed to operational efficiency and Fit4Future initiatives.

Net Profit: ₹12,546 million, up 11.2% QoQ, 10.5% YoY.

Order Inflow (TCV): $1.63 billion, up 17% YoY. Third consecutive quarter cracking the $1.5 billion mark.

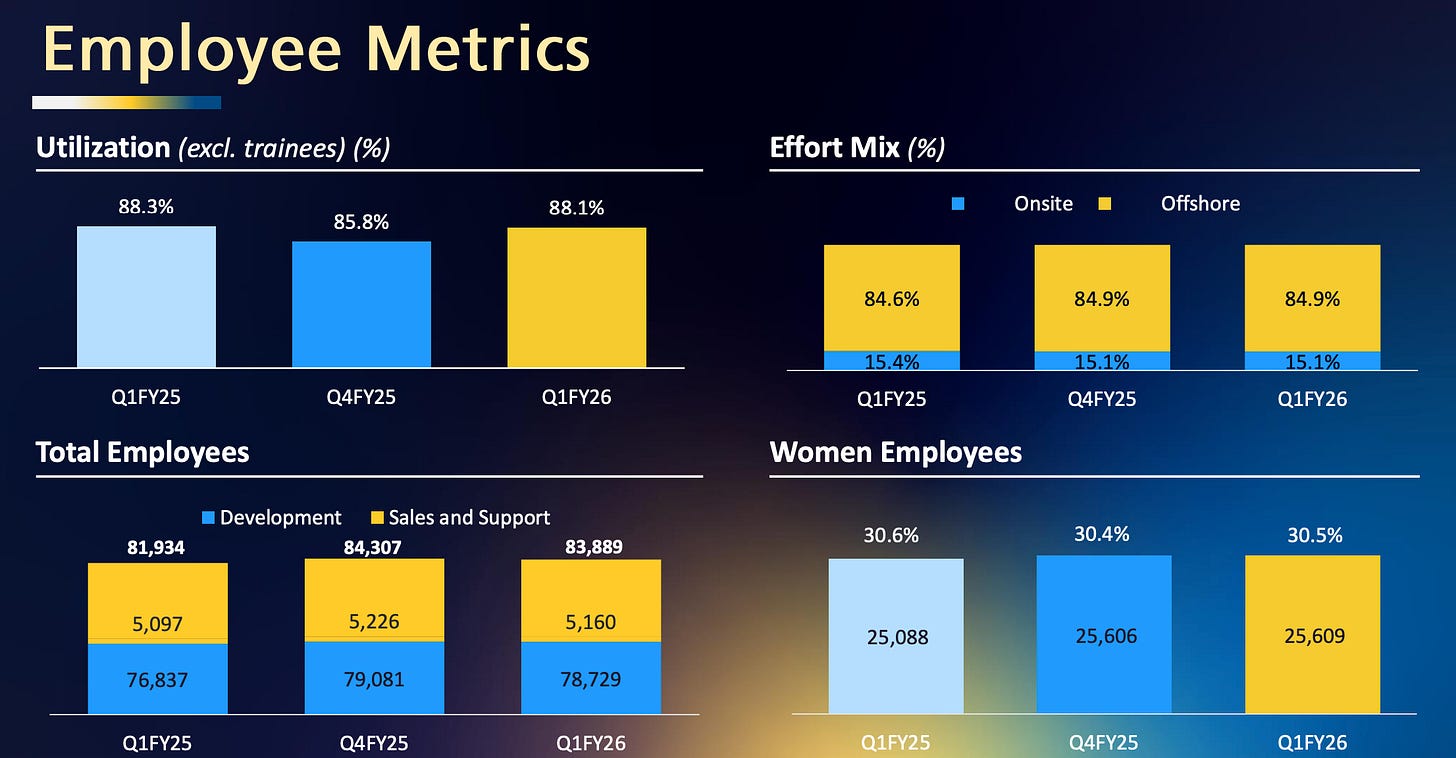

Attrition: 14.4%, stable QoQ, about flat YoY.

Utilization: Sharply up to 88.1% (ex-trainees) from 85.8% in Q4.

Headcount: 83,889, a net reduction of 418 in the quarter, with 1,600 freshers on-boarded.

The biggest takeaway is margin momentum. EBIT margins expanded even as growth stayed moderate, driven by effective cost rationalization. Revenue growth is healthy in absolute terms, though still a touch shy compared to the fastest in the sector. The order pipeline is robust.

Business Segments: Broad-Based Growth, Consumer Outperforms

BFSI (37% of revenue): Up 1.7% QoQ, 10.6% YoY. BFSI remains the anchor with continued demand for regulatory, cloud, and platform transformation.

Technology, Media & Communications (23.2%): Up 0.8% QoQ, down 4.7% YoY. Signs of stabilization, but budgets remain under watch.

Manufacturing & Resources (19.6%): Modest 0.3% QoQ rise, but up 11.6% YoY, thanks to deal ramp-ups and automation mandates.

Consumer Business (14.6%): Up 6.2% QoQ, 5.7% YoY. Best-performing vertical this quarter, led by retail and travel spend recovery.

Healthcare, Life Sciences & Public Services (5.6%): Up 4.8% QoQ, down 4.7% YoY, signaling some rebound after a soft base.

Geography:

Europe saw a standout 9.7% sequential growth (about 3% in constant currency), reflecting strong deal closures.

North America (74.4% of business): Grew 1.8% QoQ, still sluggish versus previous years.

Rest of World: Down 6% QoQ, partly seasonal.

Deal Flow and Growth Outlook: Strong Wins Position LTIM for H2

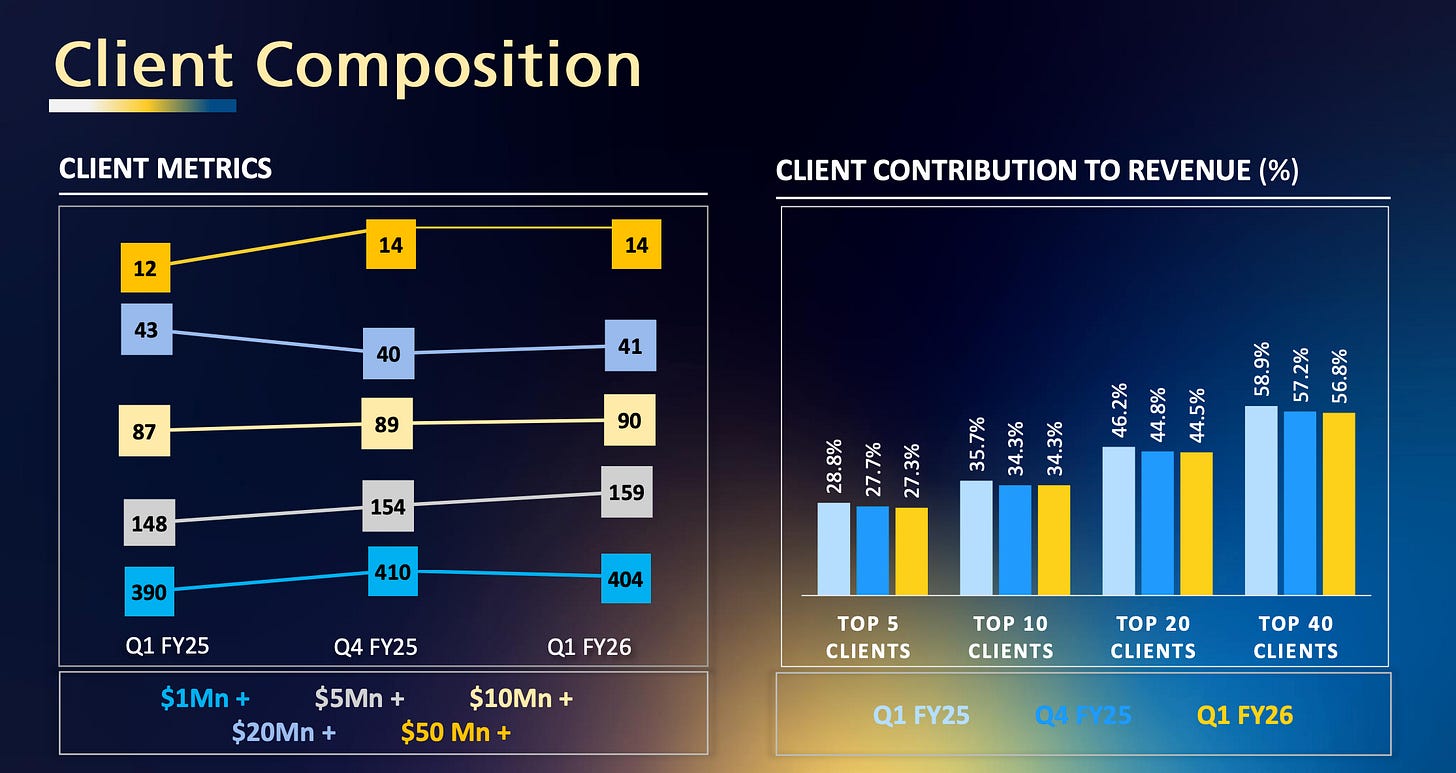

LTIMindtree booked deals worth $1.63 billion, marking the highest ever in a quarter and showing that the large deal engine is clearly firing. Vendor consolidations, core IT modernization, and AI-led engagements drove most wins.

Largest-ever project from a global agribusiness leader. Other standouts include new contracts with a Middle Eastern digital giant, a European bank, and a US oil and gas major.

Management calls out three straight quarters of strong bookings. Importantly, the company expects revenue from these deals to ramp up beginning Q2 and Q3, with no material margin drag.

Deal activity is broad-based, including BFSI, manufacturing, and consumer-facing industries. Compared to peers, this is among the sector’s most vibrant pipelines.

Management Commentary: Stability, Sales Transformation, and an AI Push

CEO Venu Lambu highlighted margin expansion and the translation of operational pivot into numbers. He credited the Fit4Future program and sales transformation initiatives for improved agility and a rising win rate in large deals. “We had a promising start to the year delivering broad-based growth, expanding margins, and making significant progress on our strategic priorities,” he stated.

The company is actively positioning itself as an AI-first enterprise. It launched the BlueVerse agentic AI ecosystem and formalized initiatives to embed GenAI and automation across client projects and internal operations.

CFO commentary points to a disciplined approach on costs. Seasonally higher SG&A and visa fee spikes dampened some of the cost benefit, but the core margin levers remain in play.

Closing Thoughts

LTIMindtree’s Q1FY26 reads like a company that has found its post-merger rhythm. The quarter brought broad-based growth, sharper margins, execution on large deals, and a credible AI story that could fuel differentiation ahead. The hard work: merger integration, sales overhaul, cost reset, looks to be paying off without the drama of zig-zag quarterly surprises.

The narrative is not without its caveats. High utilization is both a strength and a watch item. Can LTIMindtree expand without stretching the delivery engine too far? Will the deal pipeline start reflecting more tangibly on the top line? Those are the questions investors need to keep on their dashboards.

If I had to distill it to one take: LTI Mindtree is making the shift from “integration mode” to “execution mode.” The real test now is whether this steady base can turn into an industry-beating sprint over the next few quarters.