Indian IT Services Q3FY25 Results Preview: Analyzing the Mixed Bag for Indian IT Companies

With TCS to kickoff the Results season on 9th January, how to make sense of the upcoming results season for IT sector?

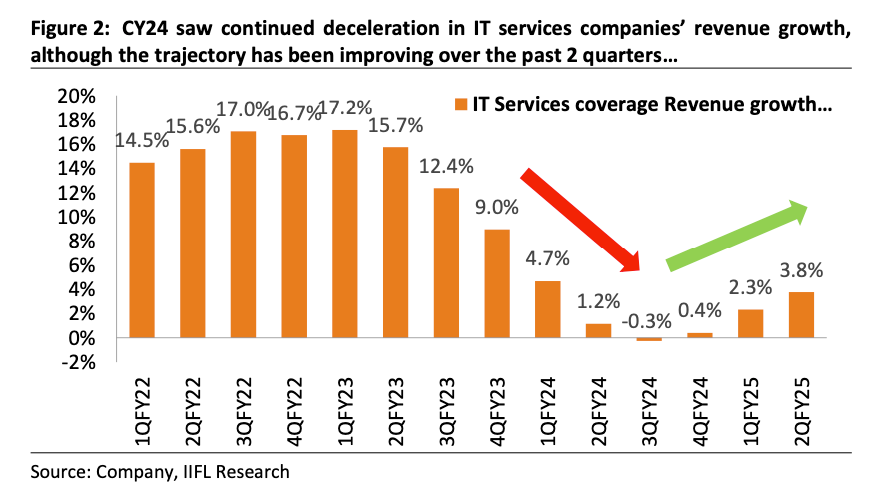

As we gear up for Q3FY25 results, the Indian IT services sector is set to deliver a mixed performance. While some companies are showing promising momentum, others are grappling with familiar challenges. Historically, the third quarter has been a subdued period for IT firms, weighed down by seasonal furloughs and holidays. This time, however, there’s a twist: a depreciating rupee might soften the blow and add a silver lining to the revenue figures.

Big players like TCS, Infosys, and HCL Tech are likely to report modest growth. On the other hand, mid-sized firms such as Coforge might outshine their larger peers, leveraging efficient operations to deliver stronger quarter-on-quarter growth. Despite the sector's ongoing recovery, company-specific dynamics will play a crucial role in shaping the overall narrative.

Currency Tailwinds Offer a Boost:

The rupee’s depreciation against the dollar—from ₹83.60 to ₹85.56—is expected to provide a temporary uplift to reported revenues. This currency tailwind may help offset Q3's usual sluggishness. However, the real story lies in constant currency (CC) growth rates, which strip away the impact of forex fluctuations and paint a clearer picture of operational performance. Investors should view this currency benefit as a one-off, not a structural shift.

Wage Hikes: A Dampener on Margins?

The wage hike landscape is creating divergent impacts across the sector. HCL Tech has introduced salary increases of 1–4% for junior employees, while TCS and Infosys have deferred their FY25 hikes to Q4. Meanwhile, firms like Wipro, LTIMindtree, and L&T Technology Services (LTTS) have gone ahead with Q3 salary revisions, which could lead to margin pressures.

This strategic delay by TCS and Infosys may allow them to stabilize or even expand margins, while competitors that opted for wage hikes could face short-term profitability challenges.

Revenue Growth Expectations:

Tier-1 IT firms are expected to deliver -1% to +5% YoY CC growth.

Mid-tier companies might show a wider spread of -1% to +20% YoY, reflecting a more diverse performance spectrum.

Among the large caps, HCL Tech is positioned to lead growth, supported by seasonality in its software business.

In the mid-cap arena, Persistent Systems and L&T Technology Services are likely to be the top performers.

Growth Drivers: The Bright Spots

Despite the challenges, several factors are keeping optimism alive:

Faster decision-making cycles and improved discretionary spending.

A recovery in the BFSI vertical.

Continued growth in cloud migration and digital transformation projects.

Incremental contributions from emerging markets and high-tech verticals.

Challenges: The Roadblocks

Of course, it’s not all smooth sailing. IT companies are navigating several headwinds:

Seasonal furloughs and cross-currency impacts could weigh on Q3 figures.

Weakness in manufacturing, communications, and retail verticals.

Soft demand in Europe and the UK continues to linger.

A lack of mega-deals this quarter adds to the uncertainty.

Spotlight on Key Players:

TCS: Likely to post flat QoQ CC growth (0%), with strength in regional markets.

Infosys: Projected 0.7% QoQ CC growth, with potential guidance upgrades.

HCL Tech: Expected to lead with 4.1% QoQ CC growth, driven by software business tailwinds.

Wipro: Forecasted to see a decline of -0.8% QoQ CC growth, with muted Q4 guidance.

Tech Mahindra: Anticipated 0.7% QoQ CC growth, reflecting steady performance.

What to Watch:

Key areas to monitor this quarter include:

Demand trends and CY25 budget outlooks.

Progress on GenAI initiatives and deal wins in emerging tech.

Sector-specific commentary on manufacturing and retail verticals.

Talent strategies amid ongoing cost pressures.

Looking ahead, the Indian IT sector’s growth story remains intact. FY26 could see a resurgence in tech spending, driven by easing macroeconomic uncertainties, post-election stability, and potential rate cuts. With profit pools expected to expand by over 35% between FY25–27, the sector is well-positioned for long-term growth, fueled by digital transformation, cloud

adoption, and emerging technologies like AI.

In conclusion, while Q3FY25 may be a mixed bag, the Indian IT sector is steadily navigating its challenges. With promising trends on the horizon and strong long-term fundamentals, this quarter could serve as a stepping stone toward a brighter future.