HCL Tech Q1 FY26: Navigating Margin Pressures with a Focus on AI and Specialized Talent

Dissecting the Q1 Results: Margin Cuts, Restructuring, and the Big Bet on AI

HCL Tech Q1 FY26: Navigating Margin Pressures with a Focus on AI and Specialized Talent

HCL Technologies' results for Q1FY26 present a narrative of strategic recalibration. The company delivered steady revenue growth but faced a notable decline in profitability, prompting a downward revision of its full-year margin guidance. The quarter reveals a tech major grappling with industry-wide cost pressures while making deliberate, and costly, investments in specialized talent and next-generation technologies like AI.

Financial Performance and Outlook

HCL Tech reported a consolidated revenue of ₹30,349 crores, an increase of 8.2% year-over-year 1. In constant currency, this translated to a 3.7% YoY growth. However, the top-line growth was overshadowed by a 9.7% decline in net income, which stood at ₹3,843 crores.

This squeeze on profitability led the company to cut its full-year EBIT margin guidance to a range of 17% to 18%, down from the previous forecast of 18% to 19%.

Key highlights from the quarter include:

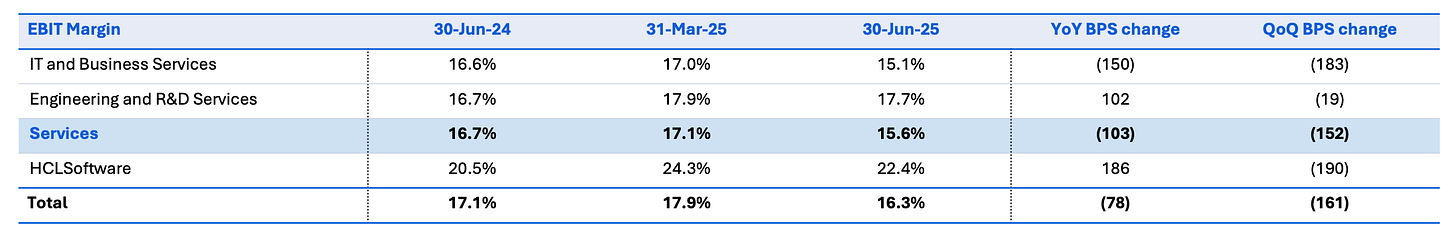

Profitability: The EBIT margin for the quarter was 16.3%, a decrease from 17.1% in the same period last year.

Deal Wins: The company secured new deals with a TCV of $1.812 billion. Management clarified that this figure was affected by the deferral of a few large deals, including a major vendor consolidation contract, into the second quarter due to procedural issues rather than macroeconomic weakness.

The Story Behind the Margin Squeeze

Several factors contributed to the compression of HCL Tech's margins:

Rising Costs: Higher personnel and subcontracting expenses were a primary cause. Employee benefit costs alone accounted for 58% of the revenue for the quarter.

One-Time Events: A client bankruptcy had a one-time negative impact of 20 basis points on margins.

Operational Headwinds: The company cited lower-than-optimal workforce utilization and delays in the ramp-up of certain projects as further pressures on profitability.

Strategic Investments: HCL Tech is actively increasing its spending on Generative AI capabilities and expanding its sales and marketing teams to fuel future growth, which adds to short-term costs.

Segment Performance Breakdown

The company's performance varied across its primary business segments:

Engineering and R&D Services (ER&D): This segment was the main growth engine, with revenue increasing by 11.8% year-over-year in constant currency and maintaining a strong EBIT margin of 17.7% .

IT and Business Services (ITBS): The largest segment saw modest revenue growth of 3.0% in constant currency, but its operating margin contracted significantly to 15.1%, reflecting intense cost pressures.

HCLSoftware: The software division reported a revenue decline of 3.0% YoY in constant currency. However, its ARR grew by 1.3%, indicating some stability in its subscription model.

A New Era of Hiring and Restructuring

In response to the evolving market, HCL Tech is implementing significant changes to its workforce strategy. The company is set to begin restructuring efforts in the second quarter, which will involve optimizing onsite locations and reducing its employee base in some areas outside of India.

Alongside this, the company is revamping its approach to fresher hiring, moving from a volume-based model to one centered on specialized skills. Despite a net reduction of 269 employees in Q1, the company added 1,984 freshers. Looking ahead, HCLTech plans to hire significantly more freshers in FY26 than the 7,000 it hired in FY25.

The new hiring strategy includes the creation of an "elite cadre" of freshers with specialized skills in high-demand areas like Data and AI, cybersecurity, and digital engineering. This select group, expected to make up 15-20% of the fresher intake, will be offered premium compensation packages: up to three or four times higher than standard entry-level salaries, to attract top talent.

This strategic pivot underscores the company's focus on building a workforce equipped for the future, particularly in the realm of AI. HCL Tech has noted strong client interest in its "Agentic AI" platforms and has entered a strategic partnership with OpenAI, signaling that it is betting heavily on AI to be a key differentiator and growth driver moving forward.

Guidance Revision:

This squeeze on profitability led the company to make a significant adjustment to its outlook. A central point of the Q1 announcement was the revision of the company's full-year guidance.

HCL Tech cut its EBIT margin forecast for FY26 to a range of 17% to 18%, a notable reduction from the previous 18-19% band. This adjustment reflects a confluence of short-term pressures and strategic investments.

Analysts attribute the 1% margin band cut to several factors, including a 30 basis point impact from higher sales and marketing expenses, a 10-20 basis point headwind from lower workforce utilization, and a 30-40 basis point allocation for upcoming restructuring costs.

Despite the margin pressures, the company’s revenue growth guidance for the full fiscal year remains between 3.0% and 5.0% in constant currency, indicating a stable demand environment.

In conclusion, HCL Tech's Q1 FY26 results reflect a company at an inflection point. It is navigating a complex environment by securing revenue growth while making deliberate, and at times costly, investments in its future.

The margin guidance cut is a frank acknowledgment of the current pressures, but the continued deal momentum, strategic restructuring, and focused investments in specialized AI talent suggest that HCL Tech is not just weathering the storm but actively retooling for its next phase of growth.

The quarter's story is less about the dip in profitability and more about the tough, forward-looking choices being made to secure a stronger position in an industry being reshaped by technology's next frontier.