Coforge Q2FY25 Earnings - When Ambition meets Execution! 🔥🔥🔥

Stellar Results, Medium term tailwinds of rise of GCCs in India, and Cloud Capex making a comeback, this company makes a strong case of being in your portfolio.

If you need more information regarding Coforge to understand the earnings announcement better, consider reading our deep dive on the same:

Coforge has been on a roll since their earnings announcement on 22nd October. The stock price has risen from around Rs. 7000 at the time of earnings announcement to Rs. 8081, a gain of 15% in a couple of days, especially during a time where there’s a correction going on in Indian Indices.

And the steep rise has not been without a reason! The company has posted stellar results, arguably the best amongst the NIFTY IT Index constituents. The revenue grew by 34.5% y-o-y and the company is sticking with their medium-term guidance of $2 billion ARR by FY27.

Financial Highlights:

Organic and Inorganic Revenue Growth: Q2 Revenue grew by 26.3% CC q-o-q. Although, not all growth has been organic as this reported revenue also includes Cigniti’s revenue which has been their recent acquisition. Organically, the company grew 5.5% CC q-o-q and 12.6% INR y-o-y. Considering the tough macroenvironment IT companies are facing, Coforge’s result presents a ray of hope.

EBITDA Expansion underplay!: Coforge’s organic business improved its H1 FY25 EBITDA margin by 125 bps YoY to 16.4%, despite a Q2 dip due to wage hikes. Cigniti outperformed expectations, with its Q2 EBITDA margin rising 360 bps sequentially to 16.2%, and management now projects it will exceed 18% by Q4 FY25, thanks to successful integration and synergies. While acquisition-related expenses and rising ESOP costs impacted profitability, management remains confident in achieving $2 billion revenue with substantial EBITDA growth in the medium term.

Key Performance Metrics:

OrderBook Momentum picking up:

Coforge had a strong Q2FY25, with fresh order intake hitting $516 million, including $67 million from Cigniti. The deals were spread across the Americas ($245 million), EMEA ($184 million), and the Rest of the World ($86 million), fueled by growth in healthcare, retail, and product engineering platforms like Advantage Go and Mona Lisa. Their 12-month executable order book jumped to $1.3 billion, up 40% from last year, thanks to big wins in North America, the UK, and Continental Europe. Management is optimistic that this strong pipeline will keep driving growth in the quarters ahead. This is a big news especially when mammoths like TCS failed to gain any large deal during the quarter.

Company’s on a Hiring Spree:

Coforge has embraced a proactive hiring strategy, adding 5,871 net employees in Q2 FY25, including 1,441 in its organic business, to stay ahead of demand. By analyzing internal project requests (“indents”) and using a strong pipeline review process, the company aligns hiring with anticipated deal closures. Their approach, praised as a “just-in-time” hiring model, enables them to meet growing demand effectively while maintaining balanced resource planning. Coforge’s close collaboration between supply chain, sales, and delivery teams, along with a strong focus on client relationships, ensures they are well-prepared to support sustainable growth.

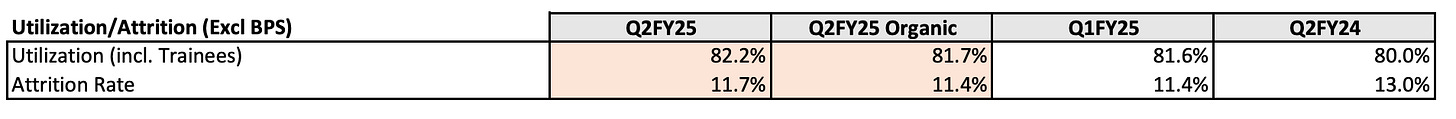

Utilization And Attrition:

Coforge has kept its utilisation rate steady at 82.2% in Q2 FY25, with year-over-year improvements, and believes this level is sustainable without pushing resources too hard. Attrition also remained stable at 11.7% (including Cigniti) and 11.4% for the organic business, showing a solid drop compared to last year. This stability reflects Coforge’s proactive hiring approach, thoughtful planning aligned with upcoming deals, and strong client relationships, all helping the company manage its workforce effectively while staying focused on long-term growth.

Medium-Term Tailwind: Direct Beneficiary of Rise of GCCs in India

During the Q2FY25 Earnings Conference Call, Coforge’s management shared detailed insights into the growing trend of Global Capability Centres (GCCs) and their impact on the company’s business strategy.

GCCs as a Growing Trend

Coforge highlighted the increasing momentum in the GCC space, particularly in IT services. Unlike past boom and bust cycles that typically spanned 3-5 years, this demand appears more sustained, driven largely by Indian-origin leaders in client organizations advocating for GCC build-outs. Management sees this as a significant opportunity to support clients with their evolving needs.

Coforge’s Approach to GCCs:

To capitalize on this trend, Coforge has developed a well-rounded strategy to support GCC development, including:

Establishing physical GCCs directly for clients.

Building virtual GCCs within Coforge’s premises.

Providing tailored solutions for both small (micro) and large-scale (mega) GCC setups.

This flexible approach ensures Coforge can cater to a wide range of client requirements, reinforcing their commitment to this growing segment.

Revenue Durability and Challenges:

Coforge acknowledged that initial GCC engagements often operate under Build-Operate-Transfer (BOT) models, which have a defined timeline. This time-bound nature poses the risk of revenue decline once the contract ends. However, Coforge has consistently mitigated this risk by delivering exceptional value, which allows them to expand their scope of work within client organizations and secure sustained revenue streams beyond the initial mandate.

A Real-World Example

As a case in point, Coforge shared a successful GCC engagement where the original contract was to set up a 500-person operation expected to finish after three years. Nine months into the engagement, the project got expanded significantly:

The 500-person operation remains active and is likely to continue for another two years.

Coforge has grown its footprint within the client organization, adding another 700 personnel across other areas, bringing the total workforce to 1,200.

Coforge sees GCCs as a major growth opportunity and has positioned itself to lead in this space with a strong strategy and execution framework. While time-bound contracts remain a challenge, their ability to consistently deliver value and expand within client organizations demonstrates a sustainable approach to growth in the GCC segment.

Expanding Partnerships: Coforge Upgraded to Microsoft Azure Expert MSP

The management of Coforge discussed their partnership with Microsoft Azure during the Q2 FY2025 Earnings Conference Call. John Speight, the Chief Customer Success Officer, highlighted their achievement of a renewed designation as a Microsoft Azure Expert Managed Service Partner, signifying their top-tier status within Microsoft's partner program. This recognition places Coforge amongst a select group of only 127 partners worldwide holding this esteemed status.

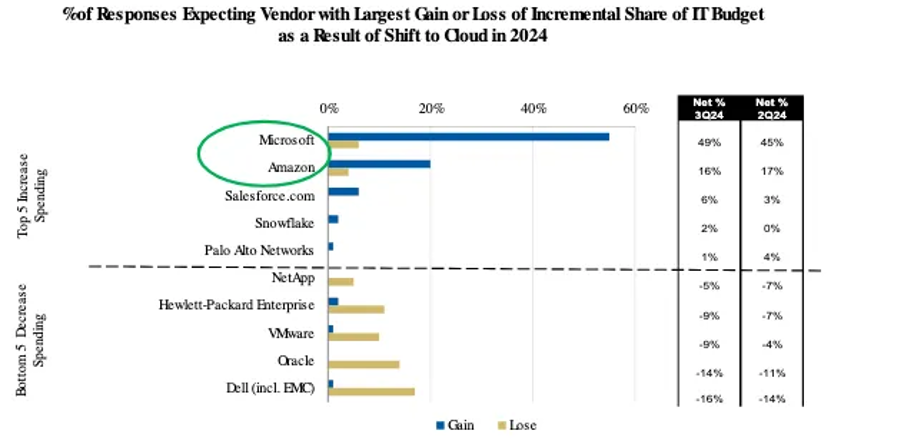

Strengthening partnership with Microsoft Azure can prove out to be crucial for Coforge’s business in next few quarters. According to Morgan Stanley’s CIO Survey, AI/ML, Security, Digital Transformation and Cloud Computing projects are projected to see the largest share of IT spends in 2025 and are least likely to be canceled/postponed as well.

Morgan Stanley’s survey showed that CIOs are especially looking forward to bring back Cloud capex next year and Microsoft Azure is their preferred cloud solution by a very large margin:

Coforge has been implementing Microsoft Enterprise Stack like Dynamics 365 and Azure cloud for a very long time and I thoroughly believe that the return of discretionary IT spend next year would benefit Coforge disproportionately if Microsoft emerges out to be the go to solutions provider for the CIOs.

Management Commentary on the Macroeconomic Environment:

During Coforge’s Q2 FY2025 Earnings Conference Call, the management provided a balanced view of the macroeconomic landscape, acknowledging challenges while maintaining an optimistic outlook for growth.

Navigating Current Uncertainties: CEO Sudhir Singh highlighted persistent macroeconomic uncertainties, particularly in the banking sector, driven by geopolitical events, high inflation, and compliance complexities. These challenges underscore the need for caution as the company navigates the evolving environment.

Positive Demand Trends: Despite these headwinds, Singh expressed confidence in the demand environment, which has shown a positive turnaround. Coforge’s robust deal pipeline, strong order book, and broad-based growth across verticals validate this optimism, suggesting resilience in client spending.

Client Investment Priorities: Clients continue to prioritize IT investments, even amidst uncertainties, with strong interest in:

Cloud computing, data services, and Generative AI.

Financial crime prevention solutions.

Compliance systems aligned with the EU’s Digital Operational Resilience Act (DORA).

Systems supporting open banking initiatives.

Mortgage Sector Recovery: The company also noted encouraging signs of a recovery in the mortgage sector, driven by declining interest rates. This is expected to boost loan origination and processing volumes, leading to higher IT spending in this sub-sector, though the company does not disclose specific revenue figures.

Coforge’s management remains cautiously optimistic, acknowledging macroeconomic uncertainties while highlighting areas of growth and opportunity. Their focus on strategic partnerships, innovation, and expanding into new markets positions them well to navigate challenges and capitalize on long-term industry trends.

Valuation and Final Thoughts:

While the company posted stellar results, and there is no doubt that the company is growing at a fast pace, the current valuations is something to be cautious about. With a current P/E of 68 and a 2-year Forward P/E of 32.8, the company is a bit overpriced. I have been holding the stock at a relatively lower value and feel comfortable to continue holding it. I believe the stock can reach levels upto Rs. 9000-9200 if discretionary IT spend make a comeback next CY and there are further rate cuts by the Federal Reserve. Beyond these levels, I would be looking out for further positive triggers, otherwise the stock can get de-rated very quickly.