Coforge (NSE:COFORGE) Deep Dive

Coforge operates as a global provider of digital services and business solutions, boasting substantial domain expertise across various industry verticals. Let's take a deep dive into the company👇

Disclaimer: This investment thesis was originally prepared as an internal memo for discussion among our investment partners. It reflects the analysis and viewpoints based on the information available at the time of its initial release. While this document is now being made available to a broader audience, the analysis may not fully reflect subsequent developments or updated data. However, we believe the stock remains actionable based on the core themes presented. This material is for informational purposes only and should not be construed as investment advice. Please conduct your own research or consult a qualified advisor before making any investment decisions.

Thesis Date: 12th May 2024:

Recommendation: BUY | CMP: ₹ 4,461* | Target Price: ₹ 6,921

* As of 12th May 2024

We initiate coverage on COFORGE with a BUY rating and a target price of ₹6,921 reflecting a 55% upside. Our conviction is supported by strong management execution, competitive positioning in emerging technologies and attractive valuation. We believe the current share price undervalues the company's potential and presents an attractive entry point for investors.

About Company:

Coforge operates as a global provider of digital services and business solutions, boasting substantial domain expertise across various industry verticals. The company's strategy revolves around delivering scalable capabilities while focusing on emerging technologies. With a proven track record in execution, Coforge prioritizes outcomes and fosters a culture centred on employees, partners, and clients. Established in 1992 as NIIT Technologies Ltd, a division of NIIT, the company's stock is listed on the Bombay Stock Exchange and the National Stock Exchange of India under the ticker symbol COFORGE.

The company maintains a global presence, spanning 21 countries, with 26 delivery centres situated across the US, Europe, the Middle East, India, Asia, and Australia. It employs over 24,000 technology and process experts who engage in engineering, design, consulting, operations, and modernization of client systems worldwide.

Valuation View:

We believe that the market reaction to the company’s Q4FY24 result and the announced Cigniti acquisition was an overreaction, and it presents an excellent entry point to investors. We see multiple levers for value creation, including, diversified customer base and cross-selling opportunities from Cigniti acquisition, margin expansion from realized synergies, and excellent management execution, which could drive the share price beyond our base case target. We also believe that the interest rate cuts by central banks are due and will be realized in H2CY24 which will provide significant tailwinds to the company.

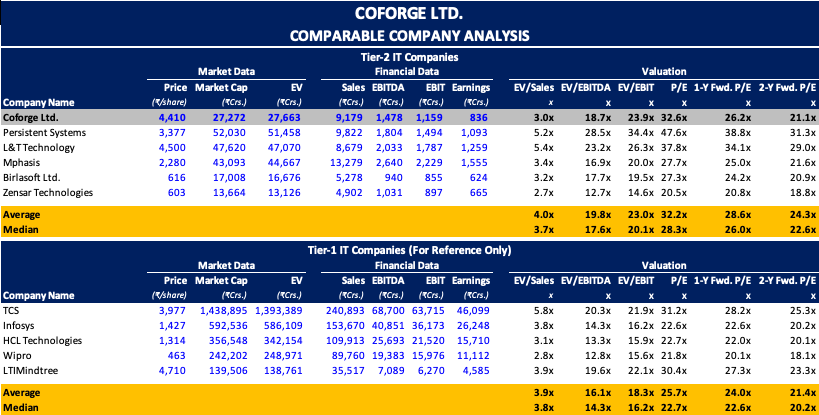

We arrive at our target price of ₹6,921 using a blended valuation approach, incorporating a DCF Analysis using Perpetuity Growth and Multiples method and a relative valuation analysis. Furthermore, Coforge trades at a discount to its peer group of Tier-2 IT companies on an EV/Sales, EV/EBITDA, and 2-year Forward P/E basis, suggesting significant upside potential.

Key Highlights:

During the Q4FY24, the company achieved a sequential revenue growth of 1.9% in constant currency terms. In terms of U.S. dollars and Indian rupees, the growth stood at 1.7% and 1.5%, respectively. In FY24, the company recorded a consolidated revenue of $1118.7 million. It achieved organic revenue growth of 13.3% in constant currency terms, 14.5% in Indian Rupee terms, and 11.7% in US Dollar terms.

The consolidated Profit After Tax (PAT) for the quarter amounted to Rs. 223.7 crores, marking a substantial increase of 94.8% compared to the same period last year.

In FY24, the adjusted EBITDA margin was recorded at 17.6%. The decline of 64 basis points compared to FY23 was primarily attributed to a 60 basis points increase in sales, solutioning, and pre-sales costs.

The growth was led by the BFS vertical, which saw a 17.1% YOY growth. The insurance vertical through the year grew by 9.6%, and the travel vertical grew 4.9%. The other emerging verticals grew 12% in dollar terms.

Coforge has agreed to acquire Cigniti Tech, a publicly listed assurance company, for an equity valuation of approximately USD 465 million. The merger comprises two components: 1) a cash purchase of 54% of shares; and 2) a share swap contingent upon shareholders' approval.

Company Overview:

Coforge, formerly known as NIIT Technologies, is a global IT solutions organization headquartered in Noida, India. The company was founded in 1981 and has since grown to become a leading provider of IT services and solutions to clients across various industries, including banking and financial services, insurance, travel and transportation, healthcare, and media.

Similar to other Indian IT firms, Coforge primarily generates its revenue from the Americas region, accounting for approximately 48% of its total revenue. The EMEA region represents the second largest market, contributing up to 40% of the total revenue. India contributes a significant 10% to the total revenue, while the remaining portion comes from APAC countries.

The company operates in four primary verticals:

Banking & Financial Services: BFS makes up the biggest share of revenue with about 34%. Despite very high furloughs in the BFS vertical, it reported a sequential growth in Q4FY24 of 6.6% in dollar terms. The vertical used to represent 16% of the company’s revenue in FY20 and has grown at a CAGR of 28.5% since then. Coforge’s specialization in this vertical used to be Asset and Wealth Management companies, but has grown to big financial institutions such as UBS, Standard Charted etc. During Q4FY24, the company signed a $400 million 6-year TCV with a large bank.

Insurance: Insurance is the second largest vertical for Coforge accounting for 22% of the revenue. Coforge specializes in Life & Annuities and Property & Casualty segment in the Insurance. The vertical used to account for nearly 30% of the revenues in FY20 and has grown at a CAGR of 15%. The growth has been relatively flat in this vertical in Q4FY24 but has shown a good growth in last couple of years.

Travel, Transportation & Hospitality (TTH): TTH accounts for nearly 18% of the company’s revenue. The vertical used be a source of nearly 28% of the revenues in FY20, but with the onset of COVID, the vertical was severely impacted, and the company had to pivot out. The vertical has shown significant rebound in the past couple of years and has grown at a CAGR of 11% over last 7 years. Coforge has earned recognition as a market leader in the HFS Horizons: Travel, Hospitality, and Logistics Service Providers, 2023 report. This in-depth research report offers insights into the state of the Travel, Hospitality, and Logistics (THL) industry, assesses digital transformation objectives, and identifies key influencers shaping the industry's trajectory.

Others: The Others vertical primarily include Healthcare, Retail, Hi-Tech, Manufacturing and Public Sector and accounts for 27% of the revenues. The vertical has grown at a CAGR of 16%. With acquisition of Cigniti Technologies, the company will be carving out 3 new verticals i.e. Retail, Hi-Tech and Healthcare.

Coforge offers six key horizontal service offerings that span across various industries and business functions that allow Coforge to provide comprehensive solutions to clients across various industries. By combining domain expertise, technological capabilities, and a focus on innovation, Coforge helps businesses transform and optimize their operations to achieve their strategic goals. The six service offerings are:

1. Product Engineering: Providing end-to-end product development services, beneficial for companies creating software products across sectors like retail, financial institutions, and manufacturing, leading to accelerated time-to-market and improved product quality.

2. Intelligent Automation: Utilizing automation technologies like RPA and AI to enhance operational efficiency, applicable to industries with repetitive tasks such as finance, insurance, and retail, resulting in increased productivity and reduced errors.

3. Data and Integration: Services focused on managing and deriving insights from data, relevant for businesses across healthcare, retail, and finance, enabling improved decision-making and enhanced customer experiences.

4. Cloud and Infrastructure Management (CIMS): Assisting organizations in adopting and managing cloud technologies, vital for businesses of all sizes and sectors, offering benefits like increased agility and enhanced security.

5. Software Engineering: Building custom software applications tailored to meet specific business needs, essential across industries for tasks ranging from ERP systems in manufacturing to CRM solutions in service-based businesses, providing competitive advantage and improved efficiency.

6. Business Process Management (BPM): Analyzing and optimizing business processes to improve efficiency and effectiveness, applicable to all organizations for tasks such as supply chain optimization in manufacturing and loan approvals in banking, leading to reduced costs and increased customer satisfaction.

Barings P.E. Takeover:

Barings Private Equity Asia (BPEA) made a significant move in 2019 by acquiring a substantial stake in Coforge Ltd, which marked a crucial juncture in Coforge's history. This acquisition was not merely a financial investment but also a strategic endeavour aimed at bolstering Coforge's capabilities and positioning within the competitive IT services sector.

Initially, in 2019, BPEA obtained about 30% of Coforge through a deal involving the purchase of shares from the company's promoters and other related entities. Subsequently, BPEA extended its ownership by making an open offer to acquire up to an additional 26% of shares, thereby surpassing the 70% mark in ownership, solidifying its position within the company.

In the years following the acquisition, BPEA embarked on a strategic journey to gradually reduce its stake in Coforge. The divestment concluded with a notable block deal in August, where Hulst BV offloaded its entire stake. This transaction reshaped Coforge's ownership structure, transitioning it into a wholly publicly-held entity. With this transformation, Coforge is poised to continue its growth trajectory under a more diversified ownership structure, encompassing a larger proportion of public and institutional investors.

Investment Thesis:

We believe Coforge is a strong BUY because of the strong management execution and its excellent positioning amongst the Tier-2 IT companies. Coforge is a leader amongst some of the key metrics that IT companies are benchmarked on:

Revenue per active client: Coforge has the highest share of revenue per active client amongst the prominent Tier-2 IT companies standing at Rs.57.63 crs per client. This is a result of the management’s strategy of cross-selling their service suite to their existing clientele and an aggressive push towards becoming the preferred IT partner. During FY22-23, the company had a repeat business from over 90% of their active clients.

Client Concentration amongst Top-5 and Top-10 Clients: In Tier 2 IT companies, their revenue is often heavily reliant on their top clients compared to Tier 1 companies. Typically, the top 10 clients contribute a significant portion, ranging from 40% to 60%, of the total revenue. Additionally, it's not uncommon for a single client to contribute more than 10% of the company's total revenue, highlighting the potential risk associated with client dependency. However, Coforge is a clear exception here with only 22.7% of its revenue being derived from their Top-5 clients and 34.3% of the revenue from Top-10 clients which is best in its class.

Exposure to Americas Region: Indian IT companies have historically focused on the Americas region, particularly the United States. While this strategy has offered significant growth opportunities, it also entails various risks that necessitate prudent management. Key risks associated with this exposure include regulatory and immigration challenges, such as fluctuations in U.S. visa regulations and stricter immigration policies. Economic risks, including downturns in the U.S. and Canada and slowdowns in specific sectors like banking or retail, can directly impact IT spending and revenue streams. Coforge has maintained a healthy balance in their exposure to all their major geographical regions. Coforge’s current exposure to North America region stands at 46.6% (post Cigniti acquisition will be 55%) which is the best amongst the mid-cap IT companies and also better than some of the large-cap IT players.

Management Commentary:

Sudhir Singh's appointment as CEO of Coforge in May 2017 marked a turning point in the organization's journey, aiming to address challenges in growth and operational efficiency. Coforge had been facing challenges in scaling its business, particularly in the face of increased competition from larger IT companies. The company had been relying heavily on organic growth, but this approach was becoming increasingly difficult to sustain.

Singh's extensive industry experience with Genpact and Infosys, coupled with his successful track record in driving growth and leading strategic transformations, made him an ideal choice. Some of the key initiatives that Mr. Singh has led since his appointment:

Senior Leadership Revamp: Mr. Singh's plan to revamp Coforge's senior leadership team involved bringing in experienced professionals known for their deep knowledge in specific fields and innovative thinking. He was specifically focused on hiring industry veterans from Tier-1 IT companies only to aid his vision of making Coforge a large-cap IT company in the near future. This restructuring was crucial in helping the company become a leader in digital transformation, leading to quick growth, better profits, and stronger relationships with clients.

Pivot from Geography based to Vertical based Business Strategy: Initially organized around regions like the Americas, Europe, and APAC, Coforge faced challenges such as limited specialization, difficulty in offering tailored solutions, and missed cross-selling opportunities. Moving away from a geography-based structure, the company transitioned to a vertical-based model to better focus on core industries, strengthen client connections, and drive growth through specialized solutions. The transformation was prompted by growing client demand for industry-specific solutions, the evolving landscape of digital transformation, and increased market competitiveness.

Shifting Focus Away from Travel vertical: Before the COVID-19 pandemic, Coforge relied significantly on the travel vertical deriving 28% of the revenue from it. However, the pandemic severely affected the travel sector, prompting Coforge to pivot strategically to reduce its dependency on this vertical and diversify its focus. Despite the challenges posed by the pandemic, Coforge maintained steady revenue growth, surpassed the $1 billion mark in revenue, improved profitability through higher-margin digital services. This strategic shift enabled Coforge to navigate the pandemic's impact on the travel industry successfully while achieving sustained growth and profitability.

Key Metrics Performance:

Aided with strong leadership and expanding growth, Coforge has been performing really well in all of the key metrics:

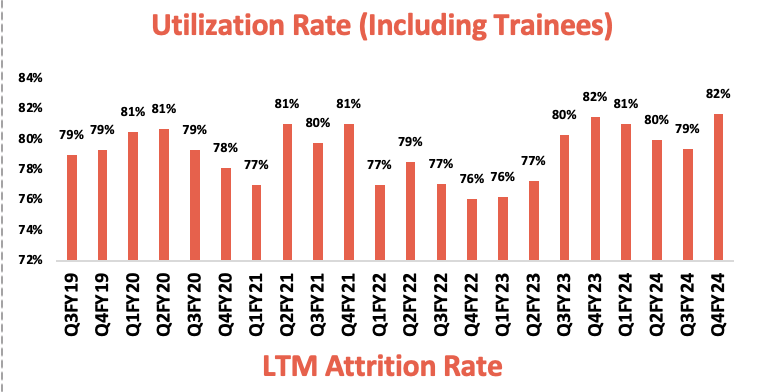

Utilization Rate: Utilization Rate for an IT company is arguably is the most important metric. It measures the percentage of time that a company's resources are productively working on client projects. The company reports its utilization rate including the trainees and it has been hovering around 80% with Q4FY24’s rate clocking at the highest ever at 82%. This rate is one of the best in the industry and beats the utilization rate of large-cap leaders such as TCS, Infosys and HCL Technologies (~80%). The company saw a blip in the utilization rate in FY22-FY23 due to company ramping up their hiring process because of signing up mega deals. Coforge also started hiring lots of freshers during this period. It takes about 2-3 quarters before the freshers can be trained and become billable.

Last Twelve Month Attrition Rate: LTM attrition rate refers to the annualized rate of employee turnover for the most recent trailing 12 months (LTM) period. Coforge has the best-in-class attrition rate with the latest rate of Q4FY24 at an all-time low of 12%. The current industry average is 17%. Even during the IT boom of FY22-FY23 when the industry was reporting attrition as high as 25-30%, Coforge’s attrition maxed out at 18%. Coforge has been constantly won awards for best workplace and the “India's Best Workplaces™ for Women 2022 - Large (Top 100)”.

Onsite vs. Offshore Revenue Mix: The onshore vs. offshore revenue mix is a key indicator of an Indian IT company's business strategy, market positioning, and financial health. A balanced mix can help the company optimize costs, maintain profitability, and manage risks across its various business operations. Offshore services typically incur lower operational costs compared to onsite services due to factors such as lower labour costs, infrastructure expenses, and economies of scale. Coforge’s used to derive nearly 66% of its revenue from onsite activities in FY20. Over the years, as the management focused on margin expansion and signed on mega deals, lot of activities were possible to be shifted to offshore centres. The onset of COVID did play the role of catalyst here. Overall, the company has been able to expand 150-250bps in margin due to this shift.

Fixed Price vs. Time & Material Revenue Mix: Fixed-price projects not only provide superior cost control but also offer Indian IT companies a greater capacity to implement automation strategies within projects, thereby enhancing profit margins. In contrast, 'time and material' contracts are intricately tied to the number of personnel dedicated to billable projects, limiting flexibility and potentially hindering efficiency gains through automation. Coforge in this metric has been relatively stable and has derived nearly 50% of its revenue from fixed price project. There has been a small uptick in the recent quarters, but one cannot derive any substantial conclusion yet.

How Realistic is Management’s guidance of $2B revenue by FY27?

The company’s revenue has been growing at 18% for the past couple of financial years. Not all of the growth has been organic i.e. the company has made some strategic acquisitions to bolster its growth. The company in their Q4FY24 earnings call announced that they will reach $2 billion in annual revenues by FY27. The company only crossed the $1 billion mark in April 2023, so naturally the street has raised some concerns on such aggressive guidance for the next 3 financial years. In an analysis, where we looked Trailing Twelve Months (TTM) Fresh Order Intake, Executable Order Book over Next Twelve Months (NTM) and TTM Revenue, we found a strong correlation between the Executable Order Book over NTM and the revenue realized in the next quarter.

The relationship between an IT company's executable order book and realized revenue serves as a vital metric for assessing various aspects of its business performance. A growing and healthy executable order book enhances revenue visibility and predictability, facilitating effective resource allocation. The ability to convert the order book into realized revenue reflects the company's project delivery capabilities and scalability potential. Management in the Q4FY24 earnings call has given a soft guidance that the Order Book will continue to grow at the same rate and the prevailing correlation between Executable Order Book and Realized Revenue will persist.

Looking at the persistent trend and the soft guidance to run a regression analysis between Executable Order Book over NTM and the TTM Revenue and the result indicated that by Q4FY27P, the revenue can easily reach $1.7 billion. This revenue figure doesn’t incorporate the Order Books from Cigniti Acquisition and the cross-selling synergies that the management is confident on realizing post-acquisition. Hence, we are confident that on a pre-text of strong execution, $2 billion is an achievable target by FY27.

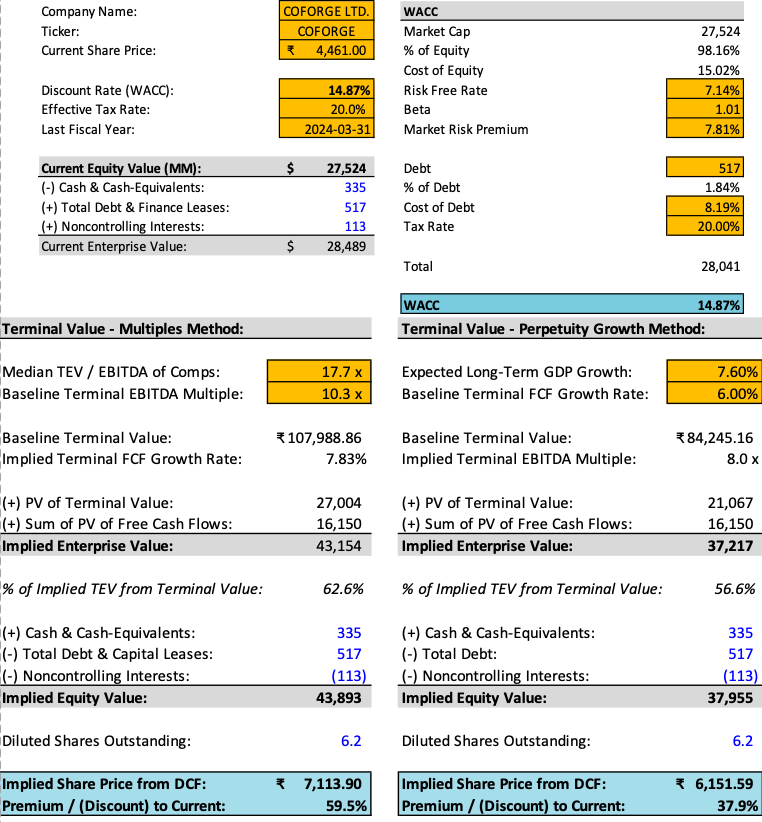

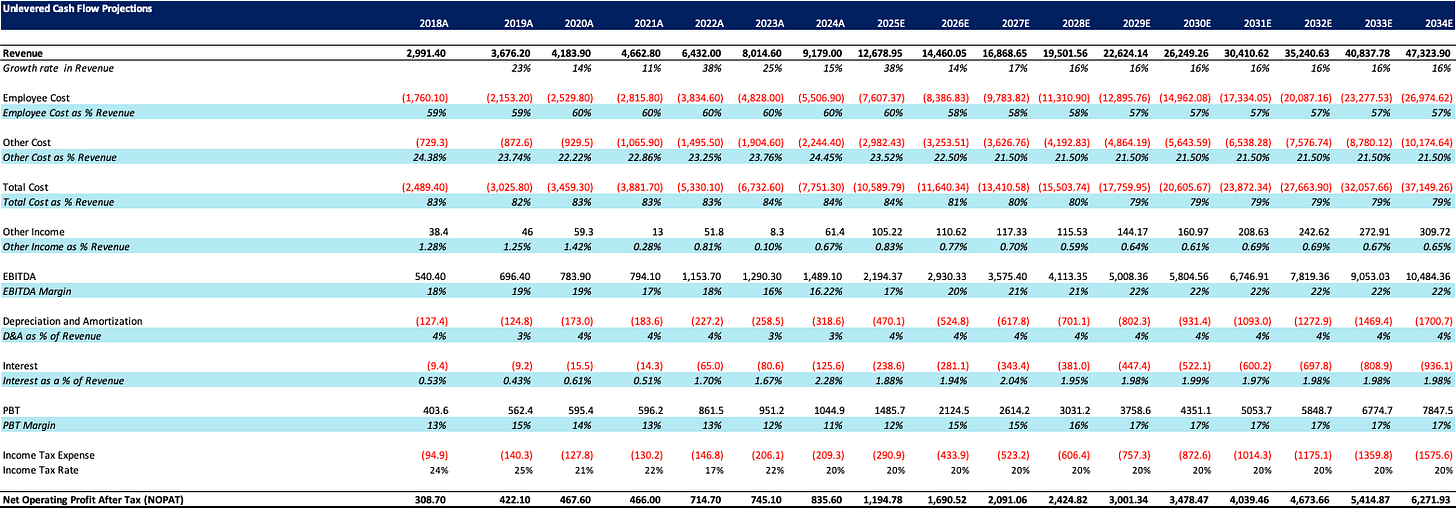

Intrinsic Valuation (DCF Analysis):

We conducted a 10-year DCF to calculate the intrinsic value of the company due to the amount of free cash flows an IT company usually generate and the nature of the growth that the company has been witnessing in the recent years.

The case for this model was formulated using guidance from historical performance, industry outlook, an assessment of ́Coforge’s competitive positioning, and company guidance on acquisitions, revenue, and earnings growth. The revenue projection included the assumption that the company will be able to successfully acquire Cigniti Technologies and will be able to realize cross-selling synergies in the subsequent years. The forecast also included 150-250bps margin improvement on the pre-text of realized synergies and management’s focus on increasing offshore activities.

This model relies on Unlevered FCF, which signifies the cash accessible to both debt and equity holders. The historical horizon is seven years (2018 to 2024), owing to the fact that the company saw a revamp in the senior leadership and business strategy.

With a WACC calculation of 14.87%, Terminal Value was estimated using the Perpetuity Growth and Multiples method. For the Perpetuity Growth method, Terminal FCF Growth Rate was assumed to be 6% and the Implied Share Price came down to ₹6,151 reflecting a 38% premium. For the Multiples Method, Terminal EBITDA Multiple was assumed to be 10.3x which is in the range of what mature IT companies trade at historically. The Implied Share price from this method came down to ₹7,114 reflecting a 60% premium. Using an equally weighted average, the intrinsic share price is ₹6,632 reflecting a 49% upside.

Relative Valuation:

To value Coforge, we also took a look at the comparable companies with a focus on 2-year Forward P/E multiple, given its wide adoption amongst the street to value IT companies. We thoroughly believe that Coforge has position itself to become a Tier-1 IT company and looking at the excellent execution in the recent financial years, it deserves to trade at a premium to the industry benchmark i.e. TCS. Looking at the chart on the right, Coforge used to trade at a discount to TCS until FY21. Looking at the turnaround, Coforge has been trading at a premium to TCS since then. We believe that the premium is deserved and Coforge should be valued at 10-15% premium to TCS’ 2-year Forward P/E of 25.3x. Using the 2-year forward EPS, the value of Coforge’s share price comes down to ₹7,210 reflecting a 61.6% premium.

Using Both Intrisic Valuation and Relative Valuation, Coforge’s Implied Share Price is ₹6,921 reflecting 55% upside.

M&A Activities:

On May 2nd, 2024, The board of Coforge approved the acquisition of a 54% stake in Cigniti Technologies, aiming to propel Coforge to a $2-billion revenue company by FY27 and improve margins by 150-200 basis points. This acquisition is expected to create three new verticals—$100 million in retail and $250 million each in healthcare and high-tech domains. Cigniti’s presence in the western US market will facilitate expansion, and the merger will introduce a new assurance service for AI. The acquisition rationale includes adding new industry verticals, expanding presence across the US, and addressing AI assurance opportunities. Cigniti’s expertise in non-functional testing and AI-powered applications aligns with Coforge's AI experience, bolstering their position as industry disruptors.

The Street and the broad shareholders were not quite receptive of the acquisition. Despite a 10% decline in shares after announcing Q4 FY24 results, Coforge remains optimistic about growth opportunities in FY25. This is not the first time that the company and its management has made such a bold acquisition. Let’s look at some of the recent acquisitions made by the company:

Acquisition of SLK Global Solution in April 2022: Coforge acquired 80% stake in SLK Global Solutions for $195 million, expanding its presence in the BFSI sector with SLK's expertise in BPM and digital solutions. The acquisition enhances Coforge's capabilities, enables cross-selling opportunities, and diversifies revenue streams while aligning with its growth strategy. SLK's global delivery centres complement Coforge's operations, and the acquisition is expected to be accretive to earnings, driving significant revenue and cost synergies.

Acquisition of WHISHWORKS in May 2019: Coforge acquired WHISHWORKS to bolster its digital integration capabilities, focusing on MuleSoft-based integration and big data solutions. WHISHWORKS' expertise provided synergies in Coforge's strategic geographic markets, particularly the U.K. and U.S., while its diverse client base offered cross-selling opportunities across various verticals. The acquisition immediately enhanced Coforge's earnings and positioned it as a leader in digital integration services, catering to the rising demand for seamless data connectivity and advanced analytics.

Financial Highlights:

Key Risks:

Some of the key risks that the company faces are:

BFSI Exposure: Coforge, like many other IT services companies, has a significant portion of its revenue derived from the Banking, Financial Services, and Insurance (BFSI) sector. While this vertical is known for its high demand for IT services, it also exposes Coforge to certain risks due to the concentration of business in this sector. Coforge considers their BFSI clients in two different verticals i.e. Banking & Financial Services (BFS) and Insurance. The company believes that the client profile in these two verticals are different and hence they are diversified. However, we are of the view that the broader risks for these two verticals are quite similar and since the company now derives over 55% of their revenue from BFSI Sector, it exposes them to significant risk in case of a downturn.

IT Spending to remain weak: The IT spending outlook for 2024 is now expected to remain flat at best. Earlier, it was expected that the IT spending will pick up in H2CY24 owing to the rate cuts by central banks around the world. However, it is now quite clear that the Federal Reserve has been evaluating the quantum and magnitude of cuts. Since, most of the central banks do mimic the Federal Reserve moves, we can expect the rates to remain higher than expected for CY24. As a result, most of the businesses will think twice before commiting to discretionary IT spends. Although, Coforge is growing at a faster pace than the IT industry, but it would be very difficult to continue to do so till they receive broader tailwinds from the economy.

Cigniti Acquisiton not working out as expected: We cannot shy away from the fact that Cigniti’s acquisition is the most aggressive the company has gone for in its history of operations. Coforge is betting on realizing synergies from cross-selling to the existing Cigniti’s Fortune 1000 clients. Usually such big clients have more than one IT partners and Tier-1 IT companies are usually one of them. The competition to acquire business in such scenario is very difficult as these Tier-1 IT companies have deep pockets and can offer services at significantly lower costs. Coforge so far has been able to grow very fast by adopting emerging technologies earlier than the competitors. However, since the emerging technologies have become more mainstream in the last couple of years, Tier-1 IT players have expanded their offerings as well, further squeezing away margins.