AFFLE India Ltd. (NSE: AFFLE) Deep Dive

With change in its sales strategy, and federal reserve planning to cut rates in H2CY24, I believe the stock presents an upside potential of 25%, making it a BUY.

Disclaimer: This investment thesis was originally prepared as an internal memo for discussion among our investment partners. It reflects the analysis and viewpoints based on the information available at the time of its initial release. While this document is now being made available to a broader audience, the analysis may not fully reflect subsequent developments or updated data. However, we believe the stock remains actionable based on the core themes presented. This material is for informational purposes only and should not be construed as investment advice. Please conduct your own research or consult a qualified advisor before making any investment decisions.

Thesis Date: 9th July 2024:

CMP: ₹1339 | TP: ₹1677 | P/E: 63 | High/Low: ₹1394/₹988

Affle India is a global technology company specializing in consumer intelligence-driven mobile marketing. Its core focus is on enhancing the advertising ecosystem through data-driven insights and targeted advertising. With change in its sales strategy, and federal reserve planning to cut rates in H2CY24, I believe the stock presents an upside potential of 25%. Using DCF Analysis, the company’s intrinsic value is ₹1677 making it a BUY.

Is there an Opportunity here?

During COVID, internet stocks were enjoying bull run and Affle was one of the beneficiaries where the stock gave 6x returns just in matter of months. The P/E ratio during the peak reached 164. However, post covid and during this era of high interest rates in the developed economies, Affle’s share price has been in a consolidation zone for past 2-3 years and the P/E ratio is hovering around 65. In these 3 years:

Sales has grown at a CAGR of 53%.

Profit has grown at a CAGR of 30%

With the company recently making a change in their strategy and started to focus more on developed markets where the average revenue per user is multiple times than their existing geographies of Asia Pacific and Latin America. I believe that the market has not yet completely priced-in this change in strategy, largely because internet stocks have been out of favor, and this could be a good opportunity to start buying here. The company also has made strategic acquisitions like YouAppi which is expected to be EPS accretive and provide a boost to the revenue. With Central Banks planning to cut rates later half of this year, the internet stocks are going to be in favor again.

Company Overview:

Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer recommendations and conversions through relevant Mobile Advertising. The platform aims to enhance returns on marketing investment through contextual mobile ads and also by reducing digital ad fraud. Affle powers unique and integrated consumer journeys for marketers to drive high ROI, measurable outcome-led advertising through its Affle2.0 Consumer Platforms Stack which includes Appnext, Jampp, MAAS, mediasmart, RevX, Vizury and YouAppi.

Affle primarily earns revenue from its Consumer Platform on a cost per converted user (CPCU) basis, which includes user conversions based on consumer acquisition and transaction models. The consumer acquisition model is focused on acquiring new consumers for businesses, typically through targeted users downloading and opening an app or engaging with an app after seeing an advertisement delivered by Affle.

Affle earns over 90% of its revenue from verticals such as E-commerce, Ed-tech, Entertainment, Fin-tech, Food-tech, FMCG, Gaming, Government, Groceries, Health-tech, and Hospitality & Travel (EFGH categories). Supported by strong venture capital funding, businesses in these rapidly growing verticals had been investing heavily in digital advertising until concerns about a slowdown emerged. Affle's above-industry organic growth suggests that it significantly benefited from this previous period of high spending.

Industry Analysis:

The world is now dominated and connected with smartphones. Increasingly, humans are getting more hooked to their smartphones and the trend is here to stay. With the 5G revolution going on in the world, humans are consuming data at an increasing speed.

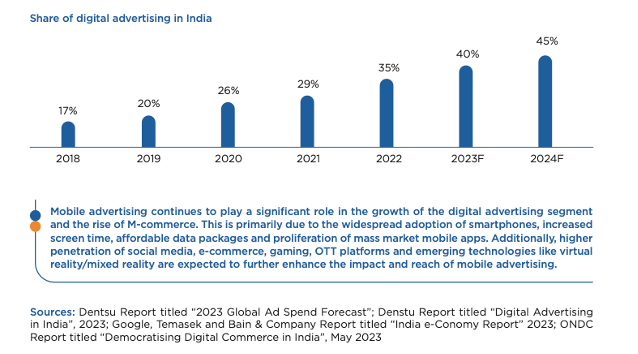

This has led to digital being the fastest growing and most adaptable nature of advertising. The digital adoption is especially on the rise since the onset of COVID. The digital advertising industry has grown globally 32.4% y-o-y to $347 billion in 2021 and 13.7% y-o-y in 2022. The digital share of ad spend is projected to jump to a whopping 60% of the Total Advertising industry by 2025.

The advertising and marketing industry is rapidly evolving with key trends such as accelerated digital transformation driven by AI, major shifts in data practices due to new regulations, and a growing demand for seamless omnichannel strategies. Ad channel dynamics are changing with Google facing competition from Amazon, TikTok, and other platforms, while streaming is moving towards ad-supported models, offering cost-effective video advertising options. The rise of AI, particularly since the launch of ChatGPT, is revolutionizing marketing through chatbots, generative search, and content generation, although challenges related to accuracy, copyright, and data privacy remain.

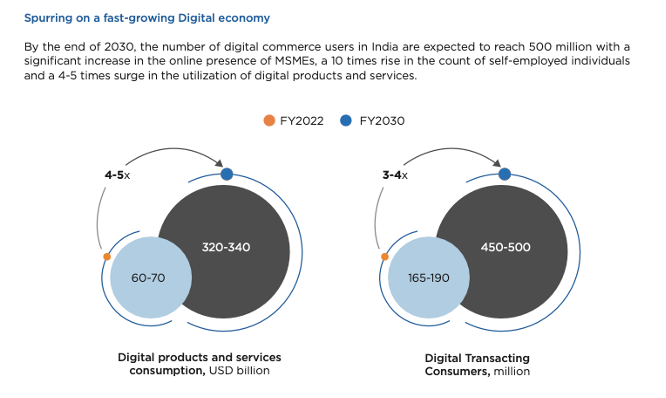

Amongst these trends, India’s digital landscape is on a rise, and it’s forecasted that the digital economy will reach $1 trillion by 2030. While the number of internet users have ballooned to 840mn, the share of that users actively involved in digital commerce remains quite low at 165mn. However, by 2030, this figure is expected to grow to 500mn presenting significant opportunity for digital advertisers to capture these potential audiences.

Medium-Term Growth Drivers:

Developed Market Focus: Just one year back, developed markets such as the United States and Europe used to account for less than 20% of revenues for Affle. The management’s focus since the inception of the company has revolved around India, Asia Pacific and Latin America. However, in late 2022, the management realized that there are many low-hanging fruits that can be realized without diverting too much of resources. Since past four quarters, the management has increased the sales team in the developed markets and as a result they have observed 105% growth in the revenue from these markets. Q4FY24 was the first Q4 in their company’s history where the quarterly revenue was more than the Q3 revenue. Typically, advertisers exhaust their advertising budget during Q3 owing to the festive season. However, Q4FY24’s revenue being greater than Q3FY24 is a sign of resilient revenue generation being shown by the company.

Focusing on the developing market also gives the company access to higher CPCU from the advertisers. According to Affle’s DRHP, in FY19, the average CPCU in Other Emerging Markets was half of that of developed markets and the average CPCU was half of the CPCU in Other Emerging Markets. Deriving more and more revenue from developed market will increase the CPCU mix resulting in better quality of revenues.

Rate Cuts by Federal Reserve: Interest rate cuts can significantly influence advertisement budgets through their impact on the broader economy and business dynamics. When central banks reduce interest rates, borrowing becomes cheaper for consumers and businesses, often leading to increased consumer spending and higher disposable income. This economic boost encourages businesses to expand their activities and invest more in marketing to capture the rising demand. Lower borrowing costs also enable companies to finance larger advertising budgets without straining their financial resources. Additionally, improved business confidence in response to an easier monetary policy often results in a more aggressive pursuit of market share, intensifying the competitive landscape. In essence, as interest rates drop, the favorable economic conditions prompt businesses to allocate more towards advertising to attract consumers and outperform competitors in an expanding market.

Longer-Term Investment Thesis:

“Premiumization” of the developing market segments:

The economy of developing markets of Asia Pacific and Latin America that forms about 72% of Affle’s revenue are expected to grow at a faster pace when compared to the developed economies of North America and Europe. Below table shows the expected growth rate of mobile advertisement industry by regions. With no surprise, Asia-Pacific and Latin America are poised to outgrow developed markets in terms of growth.

Smartphone penetration in these regions is very high and users have access to cheap internet. Coupled with these factors, the demographics of these regions are skewed to more younger population and they have grown up or growing up with excessive smartphone usage and addiction. Moreover, several statistics show that these younger people of traditionally savers economy are emerging out as heavy spenders. Evaluating the above factors holistically, one can expect that the future of advertisement is going to be mostly digital with companies spending heavily to acquire these consumers and thereby driving revenue for ad-tech companies like Affle.

Focus on Gaming Industry:

Mobile advertisement is forecasted to show exponential growth of 19.2% in Mobile Gaming Sector owing to High user engagement and programmatic in-game ads. This by far outpaces the growth of mobile advertisement in other sectors. Affle recognizes this and has made a strategic acquisition of YouAppi in April 2023 which is a gaming focused programmatic mobile app marketing platform. YouAppi uses AI and Machine learning to assist gaming companies to acquire new players, keeping them engaged, and maximizing their ad revenue, making it an asset for Affle’s growth strategy in the mobile advertising landscape.

Valuation:

Intrinsic Value: To come up for an intrinsic value for Affle’s stock, I used a 10-year DCF Analysis using Perpetuity Growth and Multiples method. The WACC for Affle used is 14.66%.

Three different scenarios were considered in the DCF Analysis and are outlined as below:

Base Case: In the Base Case, I assumed that Affle’s Converted users will be growing at a rate of 20% for a couple of years and will be ultimately coming down to 6% at the end of 10-year period. The initial growth rate of 20% is plausible looking at the historical growth rate of users have been more than 20% and company’s focus on developed markets. I have also assumed that Cost Per Converted user (CPCU) will be growing at 10% for next 2 years and will come down to 5% the end of 10-year period. The initial growth of 10% is supported by focus on developed markets where average CPCU is much higher as compared to other markets.

The blended intrinsic value of Affle’s share price under base case comes down to ₹1,803 reflecting a 34.65% premium to the current price levels.

Bull Case: For the Bull Case, it was assumed that the converted users will be growing at 20% for next couple of years and will continue to grow at a rate of 10% by the end of 10-year DCF period. For CPCU, the growth was assumed to be 10% for next four years before it ultimately tapers to 6% at the end of 10-year DCF Period.

The blended intrinsic value of Affle’s share price under bull case comes down to ₹2,513 reflecting a 87.77% premium to the current price levels.

Bear Case: For the Bear Case, I assumed that the users and CPCU will not be growing in ‘real’ terms and only nominally. Converted users’ growth was assumed to be 5% reflecting the growth rate of (population + no. of devices per user) and CPCU growth rate was assumed to be 3% reflecting average inflation in the world.

The blended intrinsic value of Affle’s share price under bear case comes down to ₹464.68 reflecting a 65.29% discount to the current price levels.

Assigning a 20% weight to the bull and bear case respectively and 60% to the base case, the intrinsic value of Affle can be calculated as ₹1677.33 which reflects a 25.26% upside potential from the currently traded levels making it a BUY.

Relative Valuation:

Just for sanity check, it’s good to compare Affle with its traded peers in Indian market. Although, Affle doesn’t have any direct competitors, we do have companies like Info Edge, Indiamart and Justdial that primarily competes on Internet for ads and hence are the companies closest to Affle in the Indian listed space.

Looking at the chart below of historical P/E, one can observe that Affle has historically traded at a discount to Indiamart and Justdial and by looking at the table above, would like to draw conclusion that Affle is in the overpriced range. However, by comparing the revenue growth of the respective companies, we see that Affle has outpaced the peer companies by a large margin, and I believe the premium is justified looking at the forecasted jump in growth in the coming months. The company is currently trading at a 2-year forward P/E of 27.5 which I think is under-valued for an internet company.

Company Risks:

The ad-tech industry has faced quite uncertainty in the recent years around the ongoing privacy concerns in many economies around the world. Governments around the world have passed regulations like GDPR in Europe, CCPA in California that regulates the collection of user data. With third-party cookies getting phased out, and Apple now allowing users to opt out from App tracking, there has been concerns of profitability and survival of ad-tech companies in the coming years.

Affle has been actively mitigating these risks and constantly adapting to the ever-changing ad-tech industry:

Privacy-led focus: Affle emphasizes privacy by design in its solutions, meaning that privacy is embedded into the development and operational processes from the outset. The company doesn’t rely on browser third-party cookies and rather than collecting personal user data, they use the device as a unique identifier and tracks it accordingly.

R&D: They invest in R&D to stay ahead of privacy challenges, ensuring that their technologies and practices remain compliant and user-friendly. Affle recently filed 15 patents in India, most of them focused on privacy management.

Compliance with Regulatory bodies: Instead of viewing privacy as a threat, Affle works actively with regulatory bodies around the world to enhance user-privacy. One such example is their subsidiary Affle International being actively involved with IMDA Singapore to work on Singapore’s Personal Data Protection Act (PDPA) and was awarded the prestigious Data Protection Trustmark (DPTM) for a period of 3 years.

Nevertheless, privacy is and will be an ongoing concern for ad-tech industry and needs to be continuously monitored.

Appendix:

DCF Model for the base case scenario: