TCS Q1FY26 Results Decoded: Margin Wins, Growth Questions

Margin Muscle, Growth Hiccups: TCS’s Q1 Earnings and the AI-Led Horizon

TCS’ first quarter scorecard was a study in contrasts: top-line wobbled, bottom-line grew. Below is my dissection of the numbers, the moving parts behind them, and what I’ll be tracking into the rest of the year.

Quick Take

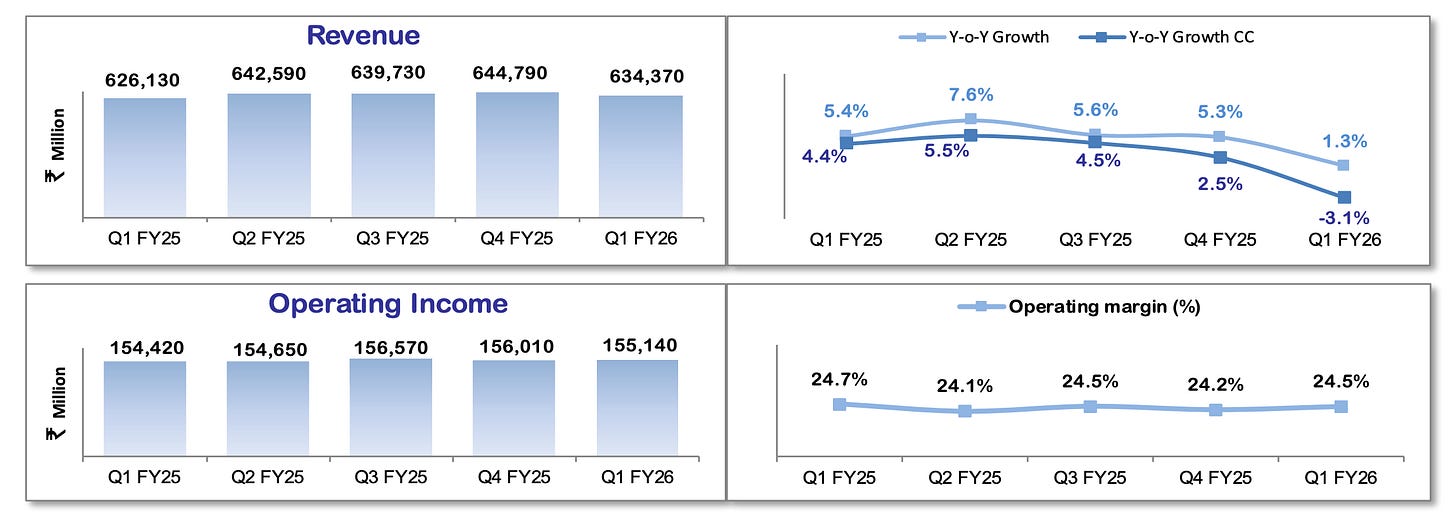

Revenue came in at ₹63,437 cr, down 3.1% YoY in constant currency but up 1.3% in reported rupees.

Operating margin expanded 30 bps QoQ to 24.5% thanks to lower third-party costs and a helpful currency mix2.

Net margin hit 20.1%, the highest in eight quarters, aided by a ~₹600 cr tax-refund interest gain.

TCV rose 13% YoY to US $9.4 bn, with North America contributing nearly half.

Headcount increased ~5.1k QoQ; attrition inched up to 13.8% but remains well below the industry peak of FY23.

TCS opened FY26 with a quarter that was more about resilience than revival. While the headline profit growth of 6% YoY and a 30 bps sequential margin expansion might suggest business-as-usual, the underlying story is one of demand contraction, deal delays, and a company leaning on operational discipline to offset top-line softness.

Revenue and Net Profits:

Of the 3.3% sequential C.C. revenue decline, 2.8% was attributed to the BSNL deal winding down, while only 0.5% was due to international business weakness.

Net profits increased ~5.9%, however, this was completely attributed to Other Income and the management clarified that this Other Income of magnitude Rs. 600 crores is one off and can be broken down into:

Extra-ordinary returns on the investments.

Interest received on the Income Tax Refunds.

North America was flat, UK and Continental Europe declined, and India saw a steep drop (–21.7% YoY CC) as the BSNL effect played out. Asia Pacific and MEA were the only bright spots, both growing modestly.

BFSI eked out 1% growth, but consumer business, life sciences, and communication/media all shrank. Tech & Services and Energy/Utilities were the rare gainers this quarter. However, the management cautioned against reading too much between the lines as the BSNL ramp off caused the percentage to be mixed.

Margins: Cost Control to the Rescue

Operating margin expanded to 24.5%, up 30 bps QoQ, as lower third-party costs (post-BSNL), currency tailwinds, and tight SG&A discipline offset the drag from underutilized capacity.

Net margin surged to 20.1%, aided by a one-off boost in other income (notably, interest on tax refunds). Excluding this, underlying profitability was still robust but less spectacular.

Long-term margin aspiration remains at 26–28%, but management signaled that further gains will depend on demand recovery and utilization improvements, especially as wage hikes are still pending.

Demand & Deal Flow: Pipeline Strong, Conversion Slow

TCV hit $9.4 bn, up 13% YoY, with North America and BFSI leading the pack. However, management acknowledged that deal conversion is lagging, with clients deferring new projects and stretching out existing ones.

AI & modernization services were the fastest-growing lines, but most new wins are cost-optimization or vendor consolidation deals, not large-scale digital transformation.

Outlook: TCS remains “optimistic” that international revenues in FY26 will surpass FY25, but the timing of a true growth inflection is still uncertain and dependent on macro clarity.

How is the company looking to expand its presence domestically in India?

The BSNL project was described as a large, strategic, and national importance program that had been successfully completed in the prior quarter.

TCS is awaiting new purchase orders for the next phase of the BSNL project (often referred to as “BSNL phase 2”), but as of Q1 FY26, execution and revenue recognition for this phase had not yet started.

The company is also looking to leverage its experience and solutions from BSNL in other public sector and emerging market opportunities. Notably, it’s working with the government in the following pockets:

Sovereign Cloud

Cyber Defence

Digital e-Governance

What did the Management say about AI?

Management iterated that AI has become an integral part in all of the conversation they are having with their customers and guided that AI is involved in real transformational work.

GenAI is being used to study legacy code.

There are three primary areas where AI is of key interest to the customers:

Customers are looking for domain specific solutions in terms of AI

Modernization of Enterprise Systems using AI

Scaling AI with enterprise/office like AI office or AI center of excellence.

AI is not acting as a revenue cannibalizer for now:

Application development is utilizing more AI from coding aspect.

‘Human+AI’ model contributing towards productivity gains.

Agentic AI is part of all client conversations now, however, there are two key areas where the company has already started working with customers:

Industry value chain solutions like BFSI and Manufacturing

Business Process Service: Automation

TCS is currently not in BPS and when asked if they are looking to acquire a player, they declined to comment.

Attrition and Hiring:

Attrition Trends:

LTM Attrition at 13.8%: IT services attrition rose to 13.8% (LTM), slightly above TCS’s comfort range of 11–13%. Management described it as “a little more than our comfort level” but emphasized ongoing efforts to reduce it through employee engagement.

Regional Variations: While specific regional attrition data wasn’t disclosed, management noted that attrition pressures are not linked to domestic demand contraction or GCCs competition.

Wage Hike Uncertainty:

No Decision Yet: Management reiterated no decision on wage hikes, which could impact margins if demand doesn’t recover.

Margin Impact: Wage hikes could pressure EBIT margins by 150–200 bps if implemented, but timing remains unclear.

Not Losing Clients!: Management Clarifies

No Loss of Clients, But Revenue Band Shifts: Management clarified that the apparent decline in the number of clients in higher revenue bands (e.g., $100 million+) does not mean that clients have left TCS. Instead, clients may move to a lower revenue band if their annual spending dips slightly below the threshold due to overall revenue contraction.

Revenue Reduction, Not Client Exit: For example, a client previously contributing $101 million annually might drop to $99.5 million amid a broad-based slowdown, thus moving out of the $100 million+ category. The client relationship remains intact, and the client continues to work with TCS.

Band Movement is Reversible: Management stressed that once growth returns, these clients are likely to move back into the higher revenue bands as their spending increases.

Impact of Overall Revenue Decline: The shift in client bands is a direct result of the overall revenue drop, which affects multiple accounts, especially those near the band thresholds.

No Market Share Loss in Key Geographies: Specifically for North America, management stated there is no market share loss. TCS continues to participate in all major engagements and is winning its fair share. The observed revenue softness is attributed to project delays or ramp-downs, not to losing clients or competitive displacement.

TCS vs. Accenture: Q1FY26 Story So far

TCS posted modest revenue growth but saw a decline in constant currency, with strong margins and robust deal wins, though deal conversion remained slow. In contrast, Accenture delivered stronger top-line growth, particularly in managed services and AI, but operates at lower margins due to a higher onsite mix and greater SG&A spend. While Accenture is monetizing AI faster and capturing near-term growth, TCS is leveraging its margin strength to weather demand softness and is focused on building capacity for future AI-led opportunities.

Valuation and Final Comments:

TCS currently trades at around 25x FY26 estimated earnings, a valuation that reflects investor confidence in its margin stability and strong cash generation rather than growth momentum. However, with constant currency revenue declining 3.1% YoY and no clear signs of a near-term demand rebound, upside appears limited. The premium multiple is underpinned by robust profitability: operating margins at 24.5% and net margins at 20.1%; but these are partly supported by one-off gains and cost resets, not structural improvements. With deal conversion remaining slow, attrition ticking up, and the risk of margin pressure from potential wage hikes, TCS’s valuation looks fully priced for stability rather than a growth revival.

Without a clear catalyst for accelerating revenue or sustainable margin expansion, the risk-reward at current levels skews neutral to mildly negative for new investors seeking upside.